In this article, Coinisseur sits down with Jos Evans – the CEO of AiX, a pioneer in the field of automated trading. With the use of AI, AiX has made the full process of trade management, from price negotiation to settlement, completely automated. Now institutions can trade selected assets, including cryptocurrencies, quicker, cheaper, and safer.

In this article, Coinisseur sits down with Jos Evans – the CEO of AiX, a pioneer in the field of automated trading. With the use of AI, AiX has made the full process of trade management, from price negotiation to settlement, completely automated. Now institutions can trade selected assets, including cryptocurrencies, quicker, cheaper, and safer.

Making OTC trading better

Currently, the process of trading large-sized orders is slow and cumbersome. Hedge funds wanting to trade need to establish trading facilities with the major market makers and have to have numerous bilateral relationships. Additionally, everything is done manually. Funds have to ask for prices, execute, and settle manually, which is incredibly inefficient.

What does AiX bring to the table?

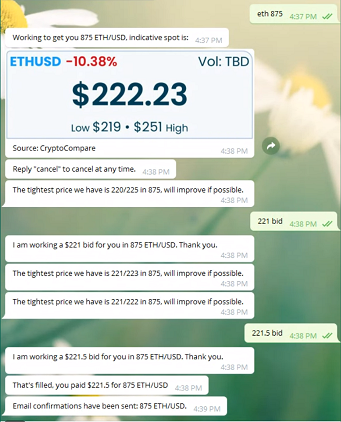

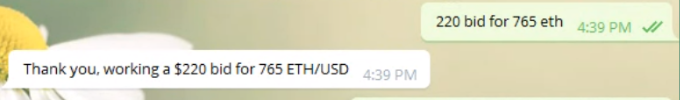

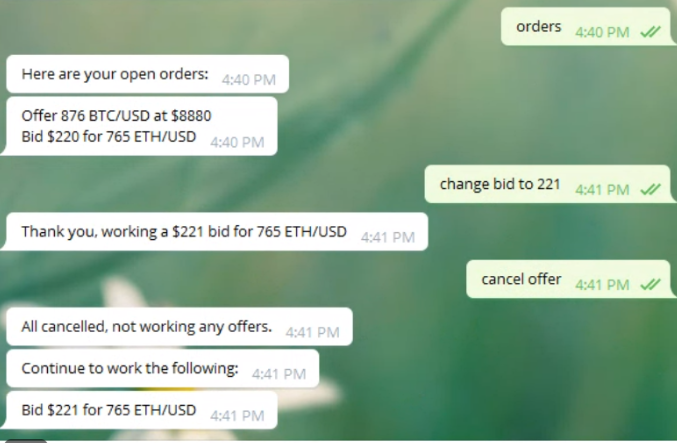

They have taken the current broking process and automated it front to back, aiming to fully replace human brokers by using an AI chatbot instead.

AiX is quicker and safer. By aggregating liquidity from 14 different market makers across the world (with this number set to increase over time) AiX is able to provide their clients with automated price discovery across the whole market, automated negotiation, execution, and settlement. For the latter, AiX partnered up with Seed CX, a regulated custodian. Clients send their funds to be held at Seed CX, the custodian then swaps the assets between the buyer and the seller. This means that funds do not have to move, and are instead kept securely at Seed CX until the client wishes to withdraw them. AiX also automatically screens new clients against blacklists and has a fully regulated KYC/AML, which means that their clients can be sure that they’re trading with clean counterparties.

AiX is quicker and safer. By aggregating liquidity from 14 different market makers across the world (with this number set to increase over time) AiX is able to provide their clients with automated price discovery across the whole market, automated negotiation, execution, and settlement. For the latter, AiX partnered up with Seed CX, a regulated custodian. Clients send their funds to be held at Seed CX, the custodian then swaps the assets between the buyer and the seller. This means that funds do not have to move, and are instead kept securely at Seed CX until the client wishes to withdraw them. AiX also automatically screens new clients against blacklists and has a fully regulated KYC/AML, which means that their clients can be sure that they’re trading with clean counterparties.

AiX is also cheaper. The total cost of execution OTC trading is often around thirty to fifty basis points, but it can be a lot higher. AiX has taken the total costs down by more than 50% to ten basis points and the goal is to bring that further down to six over the course of a year.

For the first time ever, API digital market-making liquidity is aggregated and prices are fit straight into the order book to be translated into natural language for trading directly in the chat. This allows AiX to go into any market where human brokers currently operate and offer drastic cost-saving and a much better trading process at the same time. And it is all thanks to their brilliant AI engine built from scratch.

What can you trade through AiX?

You can now trade the following crypto/fiat pairs on AiX: BTC/GBP, BTC/EUR, BTC/USD, ETH/GBP, ETH/EUR, ETH/USD, as well as stablecoins USDC (USD coin) and USDT (Tether).

AiX is in the process of getting a broker license from the FCA, and as soon as they get a green light, new trading possibilities will be added, including FX and commodity futures, with energy and dry bulk commodities planned for Q3 2020.

Interview with the AiX CEO, Jos Evans

Coinisseur: What is your background?

I was a broker for four years, then started a brokerage in 2011 and around the same time started investing in Big Data and AI startups. I sold the brokerage and started getting actively involved in the startups, really getting into the weeds of AI and software development. By the time 2016-2017 came around I was looking at the tech I had invested in, and tech that existed elsewhere and believed that I could use it to properly automate broking. I knew that would be something the market would want because the process was so expensive and slow for clients, and just clearly unfit for purpose. I set up a company in July of 2017, did Proof-of-Concept (POC) that year, got huge amounts of very positive market feedback, raised some funds and started building it in earnest. And we’ve been building it ever since.

C: What is AiX?

J: Whilst AiX looks on the surface like a very simple chatbot, what it actually is an institutional-grade trading platform that can be up 24/7 365 and will eventually be able to handle 100,000 orders per second. The intention is for this to be in every single market in the world.

We took a lot of time to build it from the outset as a proper institutional trading platform, because our clients are institutional, even in crypto. Generally, the market makers in crypto are mostly the same as traditional financial market makers so they expect the same level of service from an entity like ours as they would from the biggest broking shops in the world.

C: Can you tell me more about your AI engine?

The basic negotiation and execution function is handled by an NLP system trained using supervised learning. We then layer additional machine learning systems on top that access data lakes, scan internal and external market conditions to make recommendations to clients to replicate what the best human brokers would do.

The beauty of having the natural language element is that we can actually clarify intent with the client (‘we think you mean this, is that actually what you mean?’) which then means we can, with time, handle much more complicated products versus just a typical graphical user interface or exchange type functionality. It’s also what allows us to automate recommendations during the conversation, such as interesting technical chart patterns the client might want to be made aware of mid-negotiation.

The off-the-shelf NLP systems don’t handle numbers well so, for example, getting them to differentiate between the bid, offer, and volume was very difficult, so we had to add proprietary elements to get the system to work properly. The combination of NLP (natural language processing) and cognitive reasoning allows our system to scan huge amounts of data very quickly and make a decision about what it should do next, with the option of asking questions of the client to clarify if necessary. That’s how it replicates human decision-making, which improves over time the more it is used.

We often get asked, “what if there is an error?”. We ensure that we confirm instructions back to the client, just like a human broker would. That gives the client time to cancel or amend the instruction in case there is a problem.

The client has typically three or four steps before execution, so there re plenty of opportunities to change or cancel.

C: Moving on topic currencies. Why have you added them in the first place?

Because of the experience I had in the commodity derivatives market, which was bilateral OTC when I started in it, meaning clients had to transact directly with one another, with credit agreements in place etc. I knew that the crypto would have to transition from a bilateral to centrally cleared model. In 2017 it was typically costing one to three percent for people to trade crypto via OTC channels, so I knew that we would be able to have a monumental improvement in terms of the cost of execution, bringing down costs by 80-90%, whereas in traditional assets it is likely to be a 50% cost reduction. Crypto is a large global market and a liquid spot vanilla product in the main, which makes it a friendly environment for us to launch into. So it was a combination of seeing where we can make a huge difference and being able to prove this system out in a large global market with a friendly, tech-focused client base before we go into traditional assets where the regulatory requirements are much more expensive to manage.

C: Do you use Blockchain?

It’s obviously being used to settle cryptocurrency post-trade. We had initially intended to write an audit trail onto a blockchain for evidence that regulators could very easily access. For now, it is not necessary, but our assumption is that all clearing of traditional financial assets will be blockchain-based in the future and so we will make sure we are prepared for that outcome.

C: Do you think that blockchain will become a bigger part of the financial markets?

For sure. I think all clearing of financial products will become blockchain-based. And the really great innovation that blockchain allows in terms of trading is that effectively you don’t have to have assets move anywhere. So clients can self custody their assets but then also trade bilaterally automatically with a margin, with smart contract cross margining between the two counterparties. So effectively you have the clearinghouse model but peer-to-peer, which will save a huge amount of cost in trading and bring the systemic risk down quite a lot. I think that’s a very exciting part of the markets that we can enable because the problem with peer-to-peer trading is finding the price. But now we can do that across millions of counterparties instantly so we can absolutely enable that vision.

C: How many orders can be handled at once?

Eventually 100 000 orders per second. At the moment we’re throttled by the messenger systems to roughly a hundred orders per second, which for now is fine but once we add more assets that won’t be enough. Eventually, the goal here is for the system to be able to handle 100 000 orders/sec.

In the future, we will have the system set up in multiple different channels to provide clients with flexibility. I think it will probably be a mixture, we’ve already demonstrated that clients can have a single conversation through us using different instant messenger systems – you can start your conversation on Symphony and then switch to Telegram, and it’s still the same conversation.

C: What are the first steps in trading with AiX?

We send a client an onboarding link, then they go through an onboarding portal, upload their documentation and information. The firm and the directors are automatically checked against blacklists. Assuming they’re approved, they are sent an email with their login details and that’s where they get access to the administration portal. In that portal, they can add however many traders they have in the institution and they can set per trader what assets that trader can see, whether they can make markets, whether their prices auto-expire and if so after how much time, what sizes they want to see, etc. For instance, a market maker could say to us ‘below 100 BTC I want you to send it to my API, above 100 BTC I want all of my traders to see it on chat’. We can automate that sort of flow simply through their preferences and the administration portal. Once they’ve added users into that portal then the client just opens Telegram or Symphony and searches for AiX as a global contact.

C: Is there anything that remains to be solved?

There is a huge range of features we will add, such as the ability to scan chart patterns in real-time, backtest current conditions against historical performance and inform clients of opportunities. The beauty of the system is that it will just get better and better over time whereas a human broker will eventually leave or retire.

C: Can you tell me a little bit more about the team?

C: Can you tell me a little bit more about the team?

We’re very lucky to have top talent for every area. As an example, the head of our computational AI was the head of IBM Watson’s AI practice. So his experience is phenomenal. Our engineers are typically from the likes of Goldman Sachs, Deutsche, Morgan Stanley, they’ve been working on trading systems at investment banks for many years. On the sales front, we have very experienced traders and brokers from various different markets.

C: You’re doing to interdealers what quants are doing to human traders – you’re making them obsolete. Do you think that in the future we will have normal inter-dealers or do you think that everything will be automated?

I think that the rise of automation actually makes opportunities for humans much greater. Ultimately it’s a case of a human being able to find what opportunities are being created here, and how can they take advantage of it. The broker can switch to much higher value add role of sophisticated analytics, finding opportunities for the client. So no, I think it’s just a case of changing the core processes vs humans being obsolete.