ARYZE has recently successfully finished its ICO. It was a private presale that ran in the second half of 2018, raising around 1.6 million USD from over 280 contributors. It was one of the first, if not the actual first successful ICO from Denmark, which is especially impressive considering the brutal bear market we’ve experienced last year.

I was intrigued by this, and have sat down with their CFO and co-founder, Morten Nielsen, to try and reveal some of the secrets behind ARYZE’s fundraising success.

Coinisseur: Why did you decide to do an ICO in the first place and not the normal equity fundraising?

Morten: Because the product is fantastic, and it makes so much sense to do it that way.

Everything we do from a business perspective including our blockchain-based digital cash applications, our cloud distributed ledger fits so well with doing an ICO and tokenized financing. We also have an automated token burn mechanism embedded in our products and that ties directly into all the applications being on distributed ledgers. So the ICO model ties in really nicely and makes sense from all perspectives.

C: What was the biggest challenge during preparing for the ICO and during the actual ICO?

M: The biggest challenge was without a doubt making sure that it didn’t go public because we did a private ICO. The big difference between a private ICO and a public offering is that the latter is a regulated activity [Coinisseur has covered the topic of ICO vs IPO in this article]. So, we had to go under the radar and couldn’t use all the social channels we had access to in order to promote the token sale. We had to really go behind the scenes, and when we were asked about this, we always had to keep quiet towards the press and everybody else. It was a challenge to make sure that it didn’t come out.

C: Did you run into any regulatory issues from the government or administration?

M: No. We sent our whitepaper early on to the Danish FSA [Financial Supervisory Authority of Denmark, responsible for the regulation of financial markets], and met with them to discuss what we were doing. They consider our token [RYZE token, not the stablecoin] a borderline investment. As long as we stuck to the EU prospectus rules and capital market laws we would be fine.

C: You mentioned that you had a bit of trouble marketing it, because promoting an ICO is illegal on many platforms. Was it a big issue for you and how did you solve it?

M: We solved it by hard work. Because we couldn’t be public about it, we had a number of private meetings and events, where we made sure that nobody was streaming live or sharing anything on Facebook for example.

It’s difficult to contain if somebody that we’re not responsible for is talking about it in a public Facebook group. Then you have to basically make sure that it stops and do whatever you can to contain that. But as long as you’re aware of it, then everything is fine. In these days you can’t control all the things that happen on social media. But we’d never promoted anything ourselves. And every time we saw something being promoted, which could be perceived as being indirect marketing, we stopped it to the best of our ability.

C: Did you always want to do the ICO in Denmark, or were you considering other countries as well?

M: It had a lot to do with the basis of our core products and what we want to deliver in the future. Trust, non-corruption, a system you can trust were a strong starting point for us to do an ICO in Denmark. That was deliberate. We could have done it somewhere else, and we could have done it much faster somewhere else, but it was also an exercise in persuading investors, contributors, and traditional angel investors, and differentiating our offering from a normal equity offering – what are the cons, what are the pros, and where are the big differences, etc. When we explained the differences between how we approach this compared to other people, and we started talking about investor protection versus legal requirements, then it became obvious to them that this might be a good way to finance companies in the future. A number of people were very sceptical and for good reason. A lot of ICOs that came out in ‘17 and ‘18 were scams.

C: I think there’s a study saying 80% of them were scams.

M: And a lot of them are dead now. I just looked at some different coins of companies working somewhere in the same field, and they’re dead. They’re not supported, there’s no activity, nobody knows who’s behind it, and some changed their legal entity so that you can’t see who really originated it or who was behind it.

C: Do you think it’s important to find a country with values that fit your product or does the regulatory framework basically doesn’t matter as long as you have a good product?

M: There are two points you need to consider here. Firstly, if you issue from a well-known jurisdiction, you have to comply with the rules and regulations regarding prospectus laws. That means you cannot do a public offering; it has to be private – it would be highly dangerous and complicated to issue your ICO in a country that doesn’t have the same regulatory frameworks. For example, it would be very risky for a European (EU) company to run an ICO in a non-EU country. If you’re operating under some legal/regulatory entity, you have to do the ICO along the lines of a private equity offering. And you cannot market the whole thing properly. Secondly, you need to think about which exchanges do you want to use. Here you can go more offshore, as there are no exchanges that can facilitate ICOs in normal legal jurisdictions. You also have the option of getting FSA approval. But then it will have to be a pure utility and not an investment.

What you have to focus on is writing a prospectus, because what you put into a prospectus you are really accountable for.

You can’t hide it away in an offshore jurisdiction, hide the legal structure, and have no transparency about who’s really behind that, like what happened to Tezos and some others.

In a prospectus, you’re legally liable for the content, as you would be with anything else. So you can’t defraud people and tell them things that are completely untrue, come up with projections that are unrealistic, start saying that you would develop things that you don’t develop, and so on. If you approach it from a prospectus perspective, then the process is kind of the same as with an IPO, you just do a token sale instead of an equity sale. There’s very little difference, except that the ICO has a decentralized ownership structure, and you can trade the tokens in the crypto space just after listing, as opposed to waiting for three to four, maybe five years.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

I see a lot of benefits in ICOs now, I’m convinced that this space is coming back. Probably in an STO format, but what is the difference between an ICO and STO? The way I see it, there’s no difference. An ICO is the same as an STO, one is just called an investment upfront.

C: So what’s happening right now with the kind of STO hype, is it just a rebranding of ICOs?

M: Yeah. And STO is regulated. It’s regulated to the extent that there are ways to sell it to accredited investors in a public offering, but not to the general public. And that’s a huge benefit for people who issue one of those. An ICO is based on a white paper, which resembles a prospectus, but you often can’t sell to accredited investors in the US or qualified investors in the EU. Which means that you exclude a lot of people, which is a bit sad: you can’t sell it to students and crypto enthusiasts or whoever has a little bit of money and want to participate for 500 euros or something like that. They’re going to be excluded. So there are some disadvantages, and there are some differences, but essentially an STO is just a regulated ICO. So do you want to take the risk in calling your offering a utility ICO? I think you should just call it a security offering just to be safe even if it might resemble utility, or ask the regulators.

C: I think it was either a study or some investigation department of the US said that quite a lot of ICOs, they say that they have a utility token, but they actually have a security token. Doing a sale of a security is, I think, much more difficult than a currency or utility token. Or am I wrong?

M: Well, I mean you are wrong, and you are right.

You’re right in the sense that if it is a utility token with no expectations of a return, you have not promised or sold anything to anybody on the basis of being something that could generate a reward, return on the investment, i.e. profit, then you can sell it to anybody in the world unregulated. But who’s buying your tokens in an ICO without expecting to get something in return?

C: Well I mean that’s the utility token, isn’t? To use the platform.

M: If you look at it from a structural perspective, even utility tokens have something that would limit their supply in the future or grow in terms of size when they start being used for real. Once adoption starts happening, we expect that the price will go up in value. So, then it becomes like an indirect investment. And if you’re really stringent about it – it is an investment. Regulators say that people buy this because they expect a return, so they’re selling a sort of hybrid kind of investment/utility, and then it’s a security. My point is this: why not do the extra work it requires to do a security token offering? Utility could be something like you write some code that you place on Github and need some money to develop some hardcore back-end kind of nonprofit thing for the industry, and you need supporters for that with no expectation of returns or gains or anything like that. That could happen – I’m not saying that there can’t be a really true utility ICO, but the vast majority of them are for profit.

C: I’d like to talk a little bit about your marketing because marketing is such a big part of an ICO. How did you manage to keep the interest high for so many months?

M: We were pretty open about what we were, what we were doing, and keeping contributors informed about what time frames and what was happening.

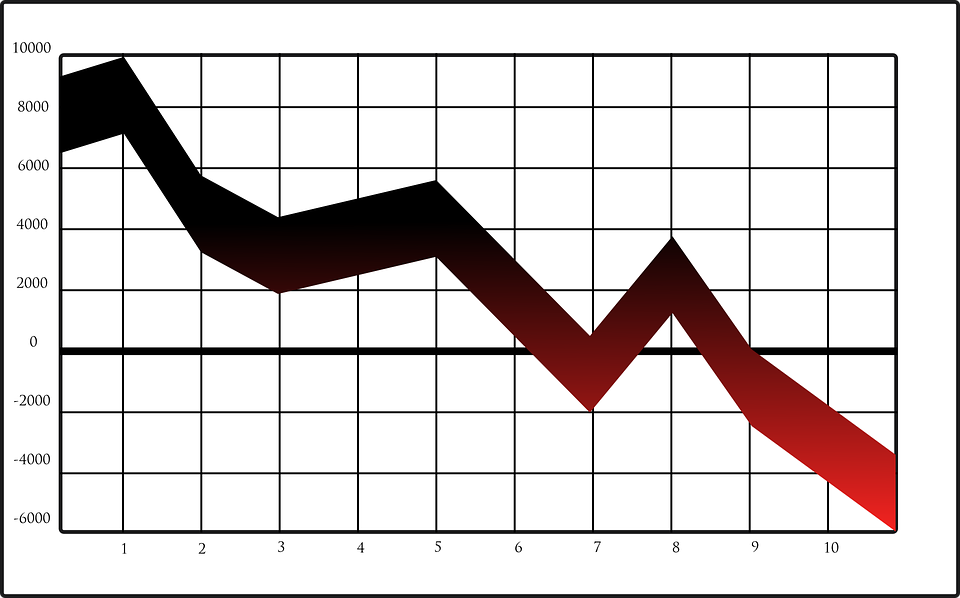

There were some people who contributed early who were a bit annoyed, well not annoyed, but feeling like “why is it taking so long?”. But all we had to do was remind them how much money they saved by having the money with us, compared to any other crypto investment, and then there were no issues. So it’s kind of like having the money in escrow for a period and then what really happened is that we were actually almost closed on the ICO before Christmas, but we decided not to be part of the 2018 negative wave, so we just prolonged it to January 2019 to be part of the new wave of much more regulatory acceptable, due-diligent ICOs and STOs with better governance.

C: So it seems that with marketing there aren’t really any hacks; it’s just hard work, being open about your business and your product, and of course having an amazing product that out competes every other solution on the market.

M: Yeah, and that means one-to-one meetings. We’ve had lots of them.

C: This is a big question: what do you think is needed to run a successful ICO? First of all, initial investment – can you tell us a little bit how much do you need to start with, do you need some initial capital even before the presale?

M: You should have funded your product and business to the extent that you’re capable of raising funds. At ARYZE, in the beginning, no salaries were paid (you can offer equity), and we’ve also won some startup competitions. It’s always a good idea to get startup capital the traditional way of financing, in order to get your business plan from conceptual to (at least) Alpha stage. And then do an ICO or an STO – but remember that you need to have a reason to do it! Ask yourself whether traditional financing would not suit you better. In our case, there is a clear business reason why we’re doing this. We want to separate ARYZE’s cash flow streams from the stablecoin. So that people can make money, and the ecosystem, through the token burns (we buy tokens back from the market), can continue to operate with our stablecoin engine room even if ARYZE ceases to exist tomorrow. And that can only be done through the tokenized structure of an ICO or an STO.

I would today also think about doing a prospectus, as I mentioned earlier. Write your whitepaper as if it was a prospectus. That means that it has to contain exactly the same thing as it would if it were a prospectus. To that you need to add some financial tokenomics (token economics) – it is really important, which is a little bit different from how you traditionally put your offering in a prospectus. Regulatory and legal frames have to be very, very clear and precise.

C: By regulatory frames, you mean under which institution you work with, which regulatory institution oversees this or…?

M: What legal jurisdiction are these tokens issued from? What Blockchain do you want to run it on, is it an ERC-20 token, which legal jurisdiction does that apply to? Is there a holding company involved that benefits from the money, etc.? Be very clear and precise about the legal connections.

It’s kind of like you’ve created a number of service contracts. There’s not even a legal word for it, because and STO is not a legal entity, so you can’t make a binding legal contract with something that doesn’t have jurisdiction from a legal perspective. But there would still be some kind of service management contracts involved that say we oblige to service the STO to the best interest of the token holders. What that means is basically that you do not start another company doing exactly the same two days afterwards. Those legal definitions need to be very clear and precise. From that perspective, we’re treating it as if it was the prospectus, so people have assurances that the IP doesn’t disappear out of the ecosystem, that revenues are not being allocated somewhere else, and that there are no competition clauses in place so we don’t start a new company, and we don’t sell the company. We ensure the rights of the token holders and interests of the token holders by making sure that we can’t sell ARYZE to somebody who wants to close it down, for example. That’s how we’re doing it, exactly like an IPO, or a regulated equity offering.

C: What you will start in May, would you call it ICO or an STO?

M: An STO. I’m 90% that it’ll be an STO.

C: Coming back to what is needed: what about people or talent? What sort of knowledge (know-how) is needed to run a successful ICO?

M: You need to be able to demonstrate that you have technical capabilities that enable you to fulfil the technical platform or technical products you want to deliver in the future. You also need to assure your contributors that you have control and can manage finances and cash flow in a proper way, and have the right people to do so. Then you need to have good marketing people and salespeople (at senior level) who understand how to not only write a roadmap (make a market plan and all the stuff that is tied into that), but also know how to execute it. At the end of the day, 90% of all successful financings fail on the ability to get their products to market and scale from that.

C: So marketing should be at the very start of the planning process along with the financial the technical know-how?

M: Yes.

It’s also very important to know your finances (operating costs, margins, projected sales, etc.). What we’ve done in ARYZE, and this is what I’m spending a lot of time on right now: I have a huge spreadsheet with variables, where you can change all the variables – you can see what happens if we run our platform differently. Stellar, for example, if we’re never going to use it, I can just put a zero on the whole Stellar model and it doesn’t apply. If I put it as one, then the Stellar model kicks into the cash flow, economics, execution, etc. I like to play around with variables, to know what happens if this and that changes. And then I make sure that we are not overfinanced. That’s one of the things you have to be really careful about.

A spreadsheet like mine is a great way to analyze your risk, how much capital you need, and variations that could occur over time – according to how successful you are in executing your plan.

Why would people give you a three of a five-year runway, instead of just doing what you need? Let’s say that you are projecting that you can start making money in the first quarter of 2020. What happens if you don’t make a penny before 2021? Then you start working on the numbers until you arrive at the amount of capital you would need – that’s a number you should get, not more. Otherwise, you’re just overfinancing the company. And people have other investments, other things they can use the money for, so you want to be careful with that. If you really want to overfinance, you should put in KPI’s [Key Performance Indicators], so that the money is released to you upon meeting certain criteria. It is complicated work, and it takes a long time to do.

C: But then you can actually make an informed decision, which I think is, basically, invaluable.

M: I see no shortcuts for that. If I’m going to put my money into anything I would want to see that. But very few deliver that.

C: And finally the product. I’m curious about its status, or readiness level – for example, with ARYZE: how much of a product did you have ready? I’m curious about the product stage at the very beginning of an ICO, or the ICO preparation stage.

M: We were, from the outset, very certain that this could be done. We knew that we could execute our plan. The question was only how we can do it in such a way that it becomes almost cost-free to move IOUs representing real money around on the Blockchain.

C: So for companies that don’t have a ready product at the beginning of the ICO – how do you foster trust and how do you make people invest in a product that doesn’t exist yet?

M: This is a really good question and it’s also a difficult one. When I do presentations, I sometimes ask people when Amazon or Netflix was founded. Closest anybody has been is five years later than they were actually founded. Some people get it wrong by 10-12 years. Amazon was founded in 1994, Netflix 1997. They’ve been around for 20 years, but people don’t realize that. And these are really successful companies today. Amazon was there very early. Netflix was there with its BitTorrent type distribution technology; before we could even stream anything, they were thinking “what can we do to stream content instead of going down to Blockbuster Video?”.

What you want to do is you want to make sure that you’re an early adopter, early into a market where there’s a market gap. But if you’re too early, it’s going to be very difficult to persuade investors that this might be a fantastic investment in the future – and that’s where we feel we are a little bit. What we’re doing right now will be obvious three years from now. We have to be in front of the curve and that’s where we are, but sometimes investors have difficulty perceiving what would be the next big thing in this space and why would it make sense.

C: Given the changing regulatory landscape and the volatile hype, do you think that launching an ICO is going to be more difficult or easier in the near future? And should we make a distinction between an ICO and an STO in this case?

M: Let me just say something without being controversial about this, it’s one of the things I presented recently in Manchester: people talked about “blockchain having failed”, “it’s not happening”, “there’s no mass adoption yet”, etc. But I think that you have to understand two things: the technology has been 10 years underway; a lot of people are working on it very seriously, but not necessarily from the crypto space. Hyperledger supports distributed databases with permissioned ledgers, they have the attraction now, and there are real working use cases right now. So, the point is this: the whole Blockchain technology came into the market from a crypto-enthusiast kind of perspective, expecting to see massive adoption of something that just didn’t work. That was not what was required for the traditional world, and it failed to see and understand that. Some think that we’ve developed a technology, and everybody should comply with what we want, but that’s not happening. So I’m asking you, and I asked the question again in my presentation last week, which Blockchain is GDPR compliant [Coinisseur has previously covered the topic of GDPR and Blockchain]?

C: That’s a tough one…

M: I don’t think there is one. I don’t know a single one, and I asked the question to the audience last week at a conference, and they didn’t know. The idea of starting a blockchain based ICO finance company and not having considered what is a legal requirement in the world: the right to be forgotten, which the crypto space doesn’t like or doesn’t accept. It doesn’t coincide, doesn’t function with the current laws. And then nobody will use it.

So, in a traditional world you have the right to be forgotten, they won’t use Blockchain, because they have to be able to delete the records. And they have to make sure that they comply with certain laws. Companies need to be able to be GDPR compliant on their own on client data. If Blockchain doesn’t do that, then it will never get mass attention and no adoption will ever happen. Another example: I had problems with that since I entered into this space around three and a half years ago – the 24/7 crypto exchange trading idea. In the last two or three weeks, the SEC has basically immediately declined several applications for regulated crypto exchanges. Based on one single point – that they want to offer 24/7 trading. One of the reasons for the SEC and the approval process is to ensure that we have a transparent and well-functioning market with enough liquidity to ensure that market manipulation cannot happen. That’s very difficult. And if you’re 24/7 trading, you can guarantee that there will be people who will try to manipulate the market (pump-and-dump, squeeze out shorts, etc.). The SEC will simply never accept that. And it doesn’t make sense either.

I’ve been working for JP Morgan in Tokyo, where they have a futures market on 10-year government bonds, where the volume was concentrated between 9 a.m. and 4 p.m., after that the market was closed. But the volumes that passed through the bond market, just in the futures, could pass 30-40 billion dollars within the first minutes of trading, and that was 20 years ago. Huge market, nobody could manipulate it. It was just literally impossible. Efficient and transparent markets with a lot of liquidity give investor protection. So, they will never accept 24/7 trading. You can now manipulate the crypto market with very little money. That’s not compatible with what is an efficient market. Some think that 24/7 trading is the new norm. It’s not.

C: Based on what you said, whether launching in an ICO will be easier or more difficult in the future is not the right question. The issue is that a lot of companies that want to do an ICO, they don’t understand the market or they don’t understand what is needed. Is that a correct assessment?

M: Yes. Because the product is fantastic. The product makes so much sense, and it’s definitely a product of the future. I think that very soon now we will see a huge amount of the new type of ICOs – STOs coming to the market, which are clearly defined in terms of what they are, and regulated, and have whitepapers that are real prospectuses, which include a lot of finance and a lot of technology, and are written in a way that potential customers understand what they’re trying to sell and what they want to do.

C: So regulation is actually good.

M: Yeah, because self-regulation never works. Self-regulation will never work because somebody will misuse it. And more importantly, when we’re talking about self-regulation: what happens if somebody who’s self-regulating breaks the rules, what would be the consequences? If there aren’t any, then self-regulation will break down. Self-regulation has never worked, and it will never work if it doesn’t have consequences if you break the rules.

C: So regulation is actually good both for the companies and for investor protection

M: Yeah. It’s not great the way it is today. It’s very difficult, with many requirements in terms of information management, handling, IT security, you name it. I mean, you’re drowning in regulation if you’re a bank or a financial institution. It’s a nightmare, it’s over-regulated right now. So somewhere in between self-regulating state of affairs towards a combined one with the current regulation would be optimal. Because you really don’t want to go through all this stuff.

Right now, you have one AML [Anti-Money Laundering] scandal after the next in the banking industry. And that’s not good. Let’s be honest about that. But it also becomes a question of saying since when has it become the banks of the world’s problem to police drug trafficking? You also have to give them some tools today so that they can monitor whatever is required, and not just leave the whole problem of solving global drug trafficking as a bank issue. I think that we’re going to find something that’s reasonable here, somewhere in between; some middle ground between the current (over)regulation and self-regulation.

C: And finally, regarding your ICO: do you have any advice for the companies that are thinking about it now, or is there anything you wish you knew before you started?

M: I think a private ICO round makes sense for every company – you need to do your homework properly and meet face to face with numerous investors. And if you don’t succeed in raising money, you can go back to the drawing board and say “listen, there’s something wrong with our business plan, or there’s something wrong with the way we present it, or we need to do this and that to change it”, and then, in the end, you end up with a really good product. It’s kind of like testing your whole business and financing plans live in front of a number of investors. And then, if you succeed in raising some money as a start-up, you can build on the top of your original business plan and in three months, six months, a year later, you have something that’s really good. And you build the product and give the early investors some benefits, discount on the token, etc. Then you sort of say “now I need to go back and think: do I have a good product? Do people believe it? Have I done my homework? Yes, or No” and if you haven’t, then you can (you need to) rethink what you’re offering. That is a lot of work, but you know it’s good for you. You don’t waste people’s money, you don’t waste your own time by going down a path which is dead three years from now anyway. It’s kind of like a reality check, to go out and meet investors face to face.

You meet everybody, from the top professional investor who really understands how to do things, to the small investors who say “I really believe that we can do something here”, in our case, in terms of financial inclusion for two billion people in the world who don’t have any access to any banking or financial services.

KYC/AML (Know your customer/anti-money laundering) are becoming increasingly important. If you are an entity that provides an exit to fiat, then you need to know where the money came from. In other words, if you are some kind of service provider that will exchange your Bitcoin to a real dollar on a bank account, then where did this Bitcoin come from? You need to be really careful with that. And the way you make sure that you can provide that certainty is that exchanges have to do their own KYC, but, unfortunately, that doesn’t happen often enough.

C: I also have a few questions about ARYZE. In a few words, what does ARYZE aim to do and how?

M: We basically want to create digital cash. A platform for digital cash, which becomes programmable money, which means that you can use them for any Fintech application living in the cloud.

C: Which products will you have?

M: The first thing in the engine room is basically digital cash – a true representation of cash in digital form, which then can be moved around the world on a Hyperledger, Stellar platform, etc., at almost zero cost, around the world

C: I’ve I read that some users are a bit confused: they think that you’re a bank. Can you draw a clear distinction between what a bank does and what will ARYZE do?

M: We are basically a facilitator of money movement. We don’t lend money, we just move money around, that’s the difference. We don’t engage in any direct banking or financial activities ourselves. We’re more in the e-money license category.

C: I’d like to talk a little bit about stablecoins. You chose an asset-backed stablecoin, why this model?

M: If you think about it from a big corporation perspective, and we have tested our business plan with some massively big corporations – they have enough problems as it is running their businesses, and their financials, and payments, and all that. They don’t want to have more market risk than they already have.

They have Dollar – Euro risk, they have British Pound versus Euro risk (currency risk) and so on. That’s more than enough for them, so they don’t want any crypto volatility on top of that. If you look at the XRP from Ripple – you don’t want to keep your money in XRP, you can use ripple (XRP) for moving values around. But if it induces excess volatility, if you keep the XRP for a longer a period of time as programmable money for digital contract management for example, then you expose yourself to excess volatility beyond core fiat currencies. And then nobody wants that in the traditional world.

C: But that’s the upside of stablecoins in general. I’d like to know why did you choose an asset-backed, model instead of crypto collateralization or the seigniorage shares?

M: Because of the second point, which seems not to be very obvious for crypto people. It’s the credit risk behind it.

I guess that market volatility has been so enormous in the last twelve months that people haven’t really thought about credit risk. But big corporations and real players in the economies of the world, they worry about credit risk; they worry about having money in a bank in Colombia or Nigeria or even the UK (Metrobank has been in trouble lately I believe, and one of the largest Italian banks went bust a few months ago).

They’re worried about these things, and they don’t want to concern themselves with credit risk if it can be avoided. That’s why we created a stablecoin based on the most credit-safe instrument you can have – which is money in a central bank.

C: The main issue with this model is the reserves: we’ve seen that with Tether. Not many people trust it now because nobody trusts that they have the reserves they say they do. How will you handle the reserves?

M: Third-party verification at all times, which makes sure that we are solvent. We’re creating a system whereby our auditors, if you want to call it that, can access all our account information (without us knowing or providing access) to verify that the amount of tokens, or e-dollars, that we issued is exactly the same as what we have in assets on the other side in banks for liquidity purposes and the vast majority placed in government-issued securities. We also overcollateralize by 2,5%.

C: What’s the upside of using government bonds over normal reserves?

M: The government cannot go default. It cannot default in its own currency; it has never happened. If they’re really getting in some serious trouble with the economy, they will just print more money.

C: I’d like to talk about MAMA [Multi Asset Modular App]. As a future user, I’m very excited about it, and I think it also ties to what we’ve talked about before – having a product that’s forward-looking and preparing for what will happen in the future. Can you tell us a bit about what will MAMA be and how will it be used?

M: There are two things to it that you should be aware of. We create the stablecoin digital cash in the engine room. When we have that, we have the basis for people to create applications on top of that engine room. So anything that becomes tokenized in the future can run on that and can enter into a multi-asset exchange and value transportation or movement, depending on whatever you want to tokenize. And you can build customized MAMA applications to exactly the needs that you might have. That could be a store card, which ties to peer-to-peer lending for local supermarkets, and investments that run through a bank, offering real services and something with tangible values to the clients.

And then it becomes all modular in a sense that you can then start working on the applications in a specific geographical environment. So that if you land in Singapore, as Jack did, you can basically look at the list and say “I would like to download the metro or local transportation app for buses, or a taxi app, or a payment app” and suddenly you’re onboarded onto the local economy based on our platform in a local environment. You go to university as a foreign student, and all of a sudden you have a canteen app running on our engine room, which means that once you have dollars in there, you can transfer dollars to Danish kroner and pay in the canteen immediately, and there’s basically no cost associated with it. It’s very efficient.

What we’re going to do then is this – we’re going to create a number of tools just like Unity did for 3D game development that makes it easy for corporations and anybody else to onboard and to create their own apps (modules) on top of our platform. That could be for example an “Oracle”, a module that makes it easier for them to translate from our blockchain technology with our engine room to another blockchain so that the information is comparable. We have a whole catalogue of things we want to develop to make it easy to create apps on top of our platform.

C: I would like to talk with you about your token RYZE because it will be a hybrid token: utility and security – can you explain a little bit more how will it work and what will its functionality be?

M: We’re going to have two different MAMA toolsets. You need a developer license to develop on our platform, and then you will get access to tool boxes and then there will be tool libraries that you can get access to. And it will be inexpensive. It will be like saying I need a developer and two weeks to develop, and I can shave a week off his time when you pay a 1000 kroner (150 USD) per year for the license and tool boxes. It’s a very efficient way of doing it. When that fee is paid, the 1000 kroner, which has to be paid in RYZE tokens. Fifty percent of that goes to ARYZE, and fifty percent goes into buying tokens back from the market into a burn pool. That way we’re constantly making sure that there’s liquidity in the RYZE token – and that way, it becomes like a live active token where there’s liquidity and things are happening all the time. If you have that kind of economic model that ties so beautifully with doing a token financing. How would you do that? Create that kind of very fair and open transparent model for revenue sharing, if it were running to a company? We can’t do that. A company can decide to acquire another company, so you don’t get any dividends paid back. That’s open to the company to do. They decide how much is going to be burned and how much will be paid back to investors. In our case, it’s completely automated. And that can only happen if you do tokenization of your finances, and ICO or an STO – that’s what I like about it because it ties in. The business into the finances and that’s completely new.

C: Finally, I’d like to ask you about the road map. Firstly, what’s your plan for the next few months, and when will we finally see the first products from you?

M: We’re preparing for Beta testing of the first product now. I don’t really want to go into details about what it is. We’ve done our first transfers and it’s working.

C: So, it’s May now. Will you start the public sale soon?

M: There are three things that need to be improved upon compared to when we did the private ICO round. One is the technical white paper and we have three people working on that day and night. It’s coming along nicely. Then we need more clarity and better-explained tokenomics. We had it, but it was not good enough. There was nothing missing, but it was not clear enough to a lot of people, exactly how the tokenomics work. And then we need a better-defined roadmap for execution. Those are the three main points. And there we have a number of big things coming up in terms of partnerships that are confidential at this point in time, but really exciting partnerships will be signed very shortly. In our case, we have a partnership coming up that will basically give us access to millions and millions of users from day 1. The product itself – end of Q1 2020 is what we hope for, maybe Q2 2020, then we should be ready with the first product. That’s kind of realistic right now. And then it’s going to be big.

C: That was it. Thank you so, so much for your time.

M: My pleasure.

In conclusion, here are a few insights from the interview on how to run a successful ICO:

- To ICO or not to ICO?

- ICOs are not suited for all companies. Before you do an ICO (or an STO), make sure that this form of fundraising fits from both business and technical perspectives.

- If you do decide to do an ICO, consider doing a private sale, but it requires numerous face to face meetings. These will reveal whether your business idea makes sense and if you’re presenting it in the right way – individual meetings are a great testing ground. Also, make sure to meet both professional investors and smaller ones to make sure that you are communicating your business model/idea effectively.

- Regulation is good. Both for you and your investors.

- Contact your financial authority early on. Sloppiness in this area early on, for example with GDPR, may lead to high fines and prosecution.

- Given the current regulatory landscape and the need for investor protection, consider doing an STO (regulated) rather than an ICO (unregulated, can’t sell to some investors).

- Product: Be an early adopter or take advantage of a market gap. But we aware that if you’re too early, some investors may not understand why your business is needed.

- Write your whitepaper as a prospectus (with detailed financial tokenomics, precise regulatory and legal frames, and detailed technical description). Make sure that it is written in a language that everybody can understand.

- Marketing: It may difficult for you to market your ICO on some platforms (Google, Facebook, etc.). Focus on one on one meetings instead. This will also allow you to foster trust, vital especially if you’re doing an ICO without a finished product.

- Know-how: you can’t start your ICO without first filling the following positions: technical (demonstrate that you can make the product from the technical perspective), finances (your contributors need to know you can properly handle cash flows), marketing and sales (you need people who can make a roadmap and stick to it).