It started in April when the price of Bitcoin rose 20% in 24 hours. Since late March, the price of BTC has doubled. What are the reasons behind this new exciting Bitcoin run?

First, you may ask: why should I care about Bitcoin’s price at all?

In short, because it defines the cryptocurrency market. Bitcoin has the biggest market cap, and as could be seen before, as BTC price drops, so do other cryptos (with some potential lag). The other way works too – when Bitcoin rises, so do other cryptos, as we’re seeing now. Bitcoin was also the first cryptocurrency; many people may not know what a cryptocurrency is, but they have heard of Bitcoin. Odds are, yours and everybody else’s first crypto purchase was Bitcoin. This makes BTC a de facto crypto reserve currency – just as US Dollar is the reserve currency of the world, Bitcoin is the reserve currency of the crypto market. In fact, research has suggested that Bitcoin will be 6th largest reserve currency in the world by 2030.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Here are the 7 possible reasons for Bitcoin’s rising value:

1. Higher Bitcoin adoption

A recent study by the Imperial College London and eToro suggests that Bitcoin will become mainstream in the next decade. It is shown that cryptos have come a long way to fulfil their promise, although some remain sceptical about them. This, however, may depend on age; as another eToro study finds, almost half (43%) of Millenial online traders trust stock market less than crypto assets. Roughly half of the respondents would be interested in allocating some cryptos to their pension. Moreover, almost one third expressed that they would invest in crypto should traditional financial institutions offer it.

Adoption also refers to retailers. And several major ones have recently announced that they will start accepting Bitcoin, such as Whole Foods, a huge American supermarket chain acquired by Amazon in 2017, Nordstrom, a Northern American chain of department stores, and Starbucks, the coffeehouse giant. And these are just the latest to join the game. This February Kaspersky Labs revealed that Bitcoin adoption by merchants has increased 700% in the last 6 years, and 13% of people have already paid online for goods with Bitcoin or other cryptocurrencies.

Based on the studies and the news about retailers, it seems that cryptocurrency future is looking well in the long-term. What about the short-term?

2. Positive news drive demand

The month of May has given us a number of good news signalling a positive long-term environment for cryptocurrencies.

One of the most important is probably Facebook’s ban lift on cryptocurrency ads. Although previous written approval is still needed, Facebook has relaxed its regulation towards what can be posted (ads related to blockchain technology, industry news, education, and events related to cryptocurrency). ICO advertisements are still not allowed. Soon after that news dropped, Microsoft has launched a decentralized identity platform on the Bitcoin Blockchain, and Bakkt, a project by the Intercontinental Exchange (leader in operating global exchanges, such as NYSE, New York Stock Exchange) aimed to promote digital assets among institutional money, merchants, and consumers, has recently announced that in the coming weeks they will be working on preparing for user acceptance testing (UAT) for Bitcoin futures and custody, expected to start in July. Finally, Fidelity Investments, which has launched a crypto unit in Fall 2018, will offer cryptocurrency trading in the coming weeks.

3. Market sentiment “immune” to hacks and scandals

While positive news and increasing adoption may be driving positive sentiment, the market also does not seem to care about the hacks and scandals as much.

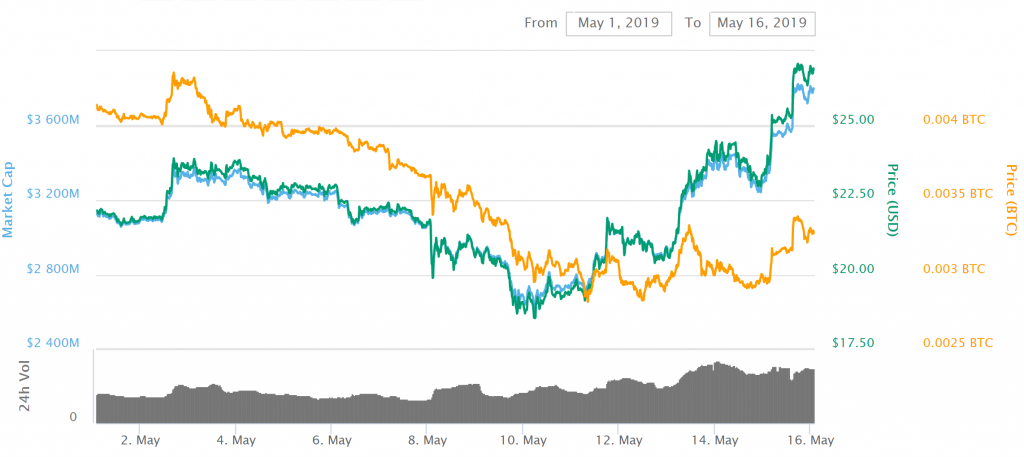

At the beginning of May news hit that Binance, one of the biggest crypto exchanges in the world, has been hacked. Around $40 million were stolen. What happened to the price of BNB (the native token of the Binance ecosystem)? You can see the drop on the 8th of May on the chart below. But surprisingly, only a few days later the price came back to its value before the hack.

There were even rumours that Bitcoin will get a re-org (a rollback of the transaction block with the hackers’ transaction). However, due to community disapproval, the news was quickly dropped on the same day.

Another news that should have rocked the market was the ongoing Bitfinex/Tether scandal. On April 25th New York Attorney General has obtained a court order against iFinex (the operator behind Bitfinex and Tether) for fraud.

“Our investigation has determined that the operators of the ‘Bitfinex’ trading platform, who also control the ‘tether’ virtual currency, have engaged in a cover-up to hide the apparent loss of $850 million dollars of co-mingled client and corporate funds” states Attorney General in a press release.

Bitfinex responded arguing that the “court filings were written in bad faith and are riddled with false assertions”.

The market was hit, with some major cryptos losing in value, and the overall market cap fell by roughly $8 billion. However, as can be seen on the graph below, both Bitcoin and the market cap recovered within days. Furthermore, in mid-May, the CTO of Bitfinex has calmed the investors in a tweet by saying that Bitfinex has raised 1 billion USDT in 10 days. Judging by the sudden price jump, he was successful.

It seems then that even though the market and the value of individual cryptos does react negatively to bad news such as hacks and scandals, it takes a very short time for them to rebound.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

4. The price is snowballing

Whatever the reason for the initial rise, the sudden jump-started a trend that quickly took a life of its own. After a few days when it became clear that the price seemed to be on a new trend, investors started to take advantage of the quickly rising price. Now there is FOMO (Fear of Missing Out), and some may feel pressured to buy the coin now and sell it later once it rises in price.

5. Maybe it’s just hype

When talking about the rising value of cryptocurrencies, FOMO, and Bitcoin’s snowballing price, the topic of hype has to be mentioned. The illogical wave of positive sentiment (hype) may be one of the main drivers of this, or arguably any, crypto bull run.

6. External market forces

Regardless of the legal status of cryptocurrencies, they do not exist in a vacuum, in any country. Global markets may affect cryptocurrency prices.

Some have suggested that the inflamed trade war between the US and China may have prompted some investors to switch from traditional fiat money to cryptocurrencies, as they are free from any government. How true is it?

We have seen crises causing people to move to crypto, for example in times of economic crises or hyperinflation, for example in Zimbabwe or Venezuela. And although the trade war may have prompted some people to purchase some Bitcoin, it is unlikely that the months-long trade war suddenly impacted a week-long Bitcoin run. In fact, there is no evidence that there is a causal relationship between the trade war and Bitcoin’s price, so we would advise you to disregard this argument.

7. Bitcoin’s technical analysis suggested bullish future

There have been numerous articles suggesting that Bitcoin has bottomed out in the last days and weeks, such as this Forbes article from the beginning of May.

Are we experiencing a temporary hype run, or is it really a start of a new year-long bull run? Let’s take a look at the charts.

A golden cross indicates a coming bull run, and we have seen the cross on Bitcoin’s chart on the 21st of April.

To confirm the positive message of the golden cross, we can look at the trading volumes. On the graph below you can see Bitcoin’s 24-hour volume over the past year, as well as its market dominance (calculated as the volume of BTC compared to the entire cryptocurrency market).

As can be seen, the volume from the last few weeks is much higher compared to the rest of the year, signalling a renewed interest in the currency.

Looking in detail at the most recent bull run it can be seen that in mid-May, the short-term RSI graphs indicated that Bitcoin is overbought (see graph below), so corrections were expected. They have come to pass on the 17th of May when the price dropped over $1000 in 24 hours. Soon, the price has stabilised to just under $8000. After each steeper rise, corrections followed.

It seems that BTC is still going strong, but this time it is not overbought.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Bitcoin’s future: short-term outlook – is the bull run over, or can we expect the price to pick up soon?

That’s the million dollar question, and to answer it we can confer previous Bitcoin cycles.

The first bull run started in November/December 2013, reaching $1142. After a small correction, the price rose again almost a month later to just under $950. It took 5 months for the price to hit its next peak at the beginning of June 2014 ($650).

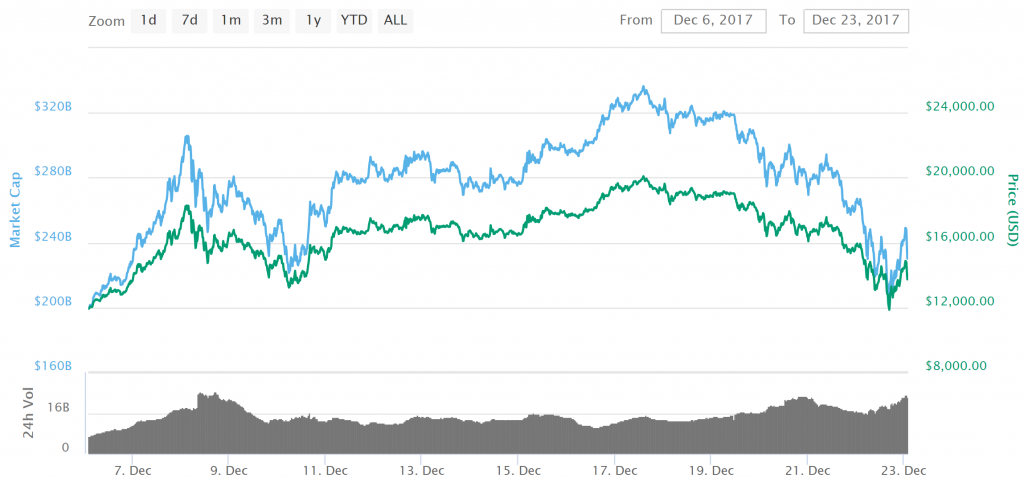

Let’s take a look now at the infamous 2017 hype. Notice the similarity between the two runs. The peak has been reached on the 17th of December 2017, at just under $20000. Less than a month later in the first days of January, the price rose to around $15500. Fell again and came up to around $11500 towards the end of February. The later peaks were reached at the beginning of March (after short correction after February), the first week of May, and towards the end of July.

On the left, Bitcoin’s price at the peak of 2013, on the right, Bitcoin’s price at the peak in May 2019.

It can often be seen on graphs that after an initial peak there is a correction, and a few days later the price returns to the level almost the same as the peak. Then, the price falls and rises (on a 1 to 5 months basis, looking at the above charts), but never reaches the peak again.

Are we to expect a fall in price then? Not necessarily, if the 2017 run is any indication.

There has been a short correction after the first peak. But after the price reached a peak again in mid-December, it fell slightly only to rise again to reach its all-time high of almost $20000.

Based on the price developments between 2013 and 2017, the price of Bitcoin can still rise (see below).

Be aware that we have now compared an all-time high in 2017 to a peak in May, but we do not know whether we have reached the height of the present bull run, or if the price will rise even more.

Bitcoin’s future: long-term outlook – will Bitcoin halving in May 2020 spark meteoric rise in value?

As part of a deflationary monetary policy hard-coded into Bitcoin, every 210,000 blocks the number of bitcoins miners receive for generating a block is halved. The initial reward, 50BTC, was halved to 25BTC towards the end of 2012 and halved again to 12.5 in July 2016. It takes roughly 4 years for the required number of blocks to be mined, and the next halving is expected to happen around May 2020 with the reward dropping down to 6.25. You can follow the countdown until the next halving here.

Does that mean that Bitcoin will “moon”? Not necessarily. It may seem logical that lower reward will decrease supply, thus jolting demand. And odds are it will. But how long will it take?

If the last halving is any indication, you should be sceptical when you hear about the upcoming meteoric rise or even any rise at all, once the halving happens.

In July 2016 when the reward dropped from 25 BTC to 12.5 BTC there was almost no change in price (or hash rate). This could be because the drop is not a surprise, and many savvy investors take it into consideration and prepare for it. In fact, the price dropped and hasn’t recovered until months later, in October/November 2016.

I have also seen arguments online that halving usually spells a new bull run. Let’s take a look at what happened last time…

So it does spell a bull run. You just have to wait a year.

So it does spell a bull run. You just have to wait a year.

The high demand for Bitcoin and other cryptocurrencies may not come from the halving, but directly from the people themselves. In April’s poll, the IMF (International Monetary Fund) asked about the preferred payment method for lunch 5 years from now.

As can be seen, cryptocurrencies have won by a long shot. The poll relates to all cryptocurrencies and not only Bitcoin but given how the price of BTC and altcoins is correlated, it stands to reason that such a positive outlook on cryptos spells well for Bitcoin as well.

In conclusion, should you buy BTC now? That depends on whether you’re looking to make short-term profits or invest in the long term. You might consider investing (some more) in BTC, we recommend eToro for a regulated exchange, but don’t buy that Lambo yet.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |