![]() Markets.com has been established in 2009 and is offered globally in a variety of languages. The platform is run by the company Safecap Investments Ltd (Safecap), based in Cyprus, and is therefore approved to provide investment services according to the Cypriot supervisory authority, Cyprus Securities and Exchange Commission (CySEC). Safecap is a subsidiary of the world’s biggest online gaming and trading software developer, Playtech PLC, that is traded on the London Stock Exchange and is included in the FTSE 250 index. Playtech acquired the company that owns the brand Markets.com in May 2015, which became a subsidiary of the business group.

Markets.com has been established in 2009 and is offered globally in a variety of languages. The platform is run by the company Safecap Investments Ltd (Safecap), based in Cyprus, and is therefore approved to provide investment services according to the Cypriot supervisory authority, Cyprus Securities and Exchange Commission (CySEC). Safecap is a subsidiary of the world’s biggest online gaming and trading software developer, Playtech PLC, that is traded on the London Stock Exchange and is included in the FTSE 250 index. Playtech acquired the company that owns the brand Markets.com in May 2015, which became a subsidiary of the business group.

Similarly to many of the competing platforms, Safecap – the company behind Markets.com and the co-brand MarketsX trading platform, is subject to Cypriot oversight and regulation. This means that you as an investor are covered by EU-based financial regulation that applies within the whole EU. This also includes important minimum protection regulation that applies to retail investors.

Which kinds of traders is the platform suitable for?

Since it’s possible, for these instruments in any case, to place a low minimum deposit per trade, you don’t have to necessarily have a big investment capital ($100 minimum). This makes the platform quite suitable for traders who would like to get acquainted with leveraged products. You can choose a language on Markets.com homepage or the web platform. This is different from some of the other available platforms, although more and more people translate the platforms and websites. It should be noted, however, that some documents like for example Investment Services Agreement cannot be translated.

Following the Investment Services Agreement, Safecap offers so-called negative balance protection, which means that a customer cannot risk losing more than his/her account balance. This should reassure many customers, especially new traders.

You also get the opportunity to open an unlimited demo account for free, where you can test the web and mobile platforms. When you test your account it is also possible to get descriptions of the many available features or quickly get in touch with a Markets employee by clicking the chat-function.

Design and platforms

Markets.com and MarketsX offers its services via a web-based platform and mobile apps (both IOS and Android).

Web-based platform

The first thing that you see, as mentioned earlier, is the language choice. But be aware that not all words and concepts are appropriately translated. Luckily, you can change the language at any moment. In order to ensure no miscommunications, English is recommended as the main language.

The platform is designed well and is easy to access. You can choose between a white and dark background, but it’s not possible to change much in the relatively locked setup. Although it is possible to enlarge or reduce graphs and trading list (in the picture, the Trade menu shows the most popular instruments among Markets’ customers).

At the bottom left, account settings can be seen, under My Account, in the form of balance, net equity, available margin, used margin, and profit/loss on open positions. Overall exposure is missing, which is unfortunately not uncommon among trading platforms. You can see more settings by clicking “My Funds” in order to open Funds Management window.

The left side of the screen shows price data for instruments, broken down by asset type or different trends. Additionally, it is possible to display the most popular instruments as well as, arguably more useful, a customised list called Favourites. You can easily add your favourite instrument to your list by clicking on the star shown on a given asset in the two other lists. Unfortunately, you can only have one list of favourites. The search function works very well when searching for specific stocks. Click on the individual asset to find useful information about it.

On the bottom right you can find graphs, which have recently been given a significant brush-up. It is now possible, among others, to see the price graph with candlesticks, see the volume (the volume contributed by Markets customers) and enter a long list of technical indicators (over 50 to choose from) for each asset. The instrument shown is the one you clicked on in the instrument list on the left side of the screen. It is possible to see open trades and trade directly from the graph. You can also see up to 4 graphs at a time on the same screen – simply click on the “More Charts” option from the menu. It is not possible to drag the graph out of the screen if you have more screens set up. If you wish to do it, you need to open the web trader in different windows. It actually works quite well, and you can have plenty of open charts. It is likewise possible to enter support lines, trend channels, apply Fibonacci retracements, etc., which are included in the individual instruments that you choose to display. All in all, it should be said that the graphs on the Markets platform work really well, as opposed to previous editions.

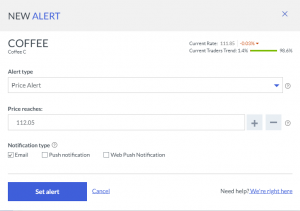

You can also set price alarms by clicking on the little alarm clock on the given asset’s oversight. The alarms can be received by email or push notifications.

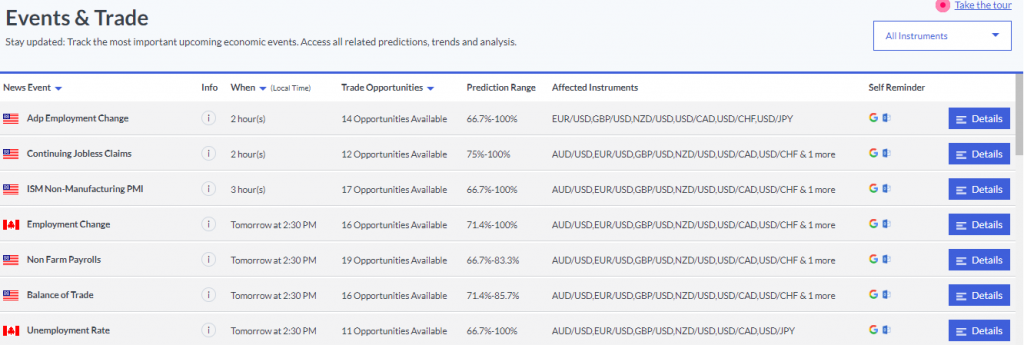

“Trading tools” is an interesting feature found at the top right of the menu. Under it, you can find among other things detailed overview of for example analysts consensus relating to individual trades, upcoming key economic data, trading ideas, and a wide range of useful information. You can also find here different analysts’ recommendation regarding individual stocks, and if you activate Trading Central, you get access to various technical analysis tools. Finally, you can see information about insiders’ trades in various stocks, which some investors see as a substantial input for one’s investment decisions.

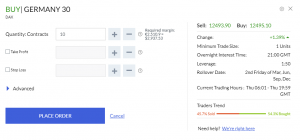

Orders can be made quickly by clicking buy or sell on a given asset on the price list on the left side of the screen, after which an order box opens. When you click on the little “i” on the price list, a list of helpful information is shown, such as minimum trading volume, margin requirements, overnight fee, rollover date, etc.

When placing your order, you have the possibility to set a stop loss. Potential profit is calculated at every price level, denominated in one’s chosen currency. Which is quite an elegant feature.

The exposure you assume will also be converted into your local currency, which gives a nice overview. This is definitely a feature that other trading platforms could stand to offer as well, as it is not always obvious how big is one’s exposure in a given trade.

All in all, the order box is quite informative and functions well.

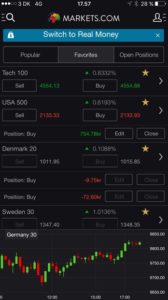

Mobile platforms

The mobile app can be downloaded to Android and iPhone. It is a simple, straightforward and user-friendly app that offers basic necessary functions, and not much more. You get access to price data, simple graphs, as well as trade and deposit functions. You also have the possibility to transfer and withdraw funds and see your deposit history.

Navigation around the relevant menus is easy and quick, trading is made simple as well. You have a choice between a black and white background.

In short, it could be said that the mobile app is a useful supplement to the web one, particularly when you don’t have access to the latter.

Margin requirements and leverage

When it comes to leverage, Markets.com distinguishes between experienced and inexperienced customers. Whether someone is considered experienced or not is determined by a compulsory test (Appropriateness test, as they call it), which aims to establish whether leverage is at all suitable for a given customer.

An Experienced customer is defined as a patron that has scored high on the test, i.e. one that has demonstrated a satisfying level of knowledge and experience with complex financial instruments such as CFDs. An inexperienced, or rather a Less Experienced customer as Markets has called them, is a client that did not meet the criteria of an experienced trader.

Should you be characterised as an inexperienced customer, you will receive additional risk warnings that you have to accept. Additionally, less experienced traders can only leverage up to 50x (leverage 1:50, corresponding to the margin requirement of 2%). If you made at least 40 trades in the last four consecutive months (at least 2 per month), higher leverage will be automatically unlocked.

In comparison, if you are categorised as an experienced customer, as a starting point you can leverage up to 50x, and you subsequently have the possibility to choose a higher (or lower) leverage, up to 1:300 depending on the asset class. If you choose the highest factor, you can leverage cryptocurrency pairs up to 300x, stocks and commodities up to 200x while individual stocks can typically be leveraged 1:20.

If you fulfil these criteria, you can choose your leverage under My Account and Settings.

Markets and products

Markets.com offers over 2.000 different CFD products divided by stock indices, commodities, ETFs (passive index funds), individual stocks, currency pairs, bitcoin, and a few bonds. All the offered instruments, spreads, leverage factors, etc. can be seen here: http://www.markets.com/da/cfds#Shares

Stock Indices

You can trade all the major indices from over 20 countries. When trading on an index you typically have to trade a minimum of 1 lot per 1 contract at a time. In the case of a stock index, 1 lot constitutes the value of the index (denominated value). This means exposure on e.g. DAX (G30) of around 12.900 EUR. The margin requirement is a default 2%, which corresponds to leverage 1:50.

If you wish to trade smaller amounts on DAX, be aware that the minimum exposure currently constitutes around 15.000 USD, and therefore requires a margin of around 300 USD with 2% margin requirement. As such, you need to have at least 300 USD in your account in order to be able to contract trade on DAX. You should also make sure that you have enough money on your account so that in case the price goes opposite to what you expected, your position won’t be closed due to a margin call.

DAX requires a minimum spread of 1,2. Dow Jones of 2, while SP500’s is 0,6.

It can be mentioned that the offered stock indices (and certain other instruments) are priced based on short-term underlying future of the individual index. It follows then that the traded price level can differ from the market sport prices, which means that the contracts have to be “rolled over” when a future expires. This will cancel any associated orders. You can find relevant dates under the individual instrument’s information. As a trader, you should pay attention to this on this platform.

Individual Stocks

Individual Stocks

If you want to trade CFDs based on stocks, Markets.com and MarketsX offers over 2000 stocks without requiring brokerage commission or paying real-time prices. There are stocks available from major international markets. It is also possible to trade a number of Chinese and Russian stocks, which could be tempting. One Japanese stock, Nintendo, has also found its way onto the platform.

You can trade as little as 1 piece of a given stock, which makes the platform suitable for low exposure trading. Margin requirements are typically 5%, which corresponds to a leverage factor of 20 (however, the requirement is higher for particularly risky stocks). Financing fees related to holding a stock contract overnight typically fall around 4% per year.

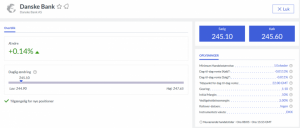

Let’s take an example of Danske Bank. You can trade 1 piece of Danske Bank’s stock at a time. Let’s say the bid-ask prices were 200 and 200,5 kroner (around 30 USD), i.e. a spread of 0,5 (circa 75 cents), which corresponds to 0,5%. In comparison, if you traded directly on the stock exchange, the spread would be 0.1-0.2 kr. – ca. 0.2%. The spread on Markets.com is thus slightly higher compared to trading directly on the stock exchange, but on the other hand, you don’t pay for brokerage. This means that at the end of the day, trading small positions can turn out to be cheaper on Markets.com.

Er man vant til at handle med udenlandske aktier vil kurtagen typisk være noget højere end for de danske, hvorfor der kan være endnu mere at spare. Ved udenlandske aktier, hvor der er en større volumen, vil spreadet typisk være noget mindre hos Markets.com. Translate?

Commodities

Commodities

You can trade 15 different commodities CFDs with possible leverage of up to 200x. Default is 1:50. Among others, you can trade US crude oil (as little as 10 contracts at a time), which gives the exposure of around 550 USD. The minimum spread is 0,3 USD.

Currency pairs

Currency pairs

More than 50 currency pairs are available, including all the major currencies, some smaller ones, and more exotic currencies. You can trade around the clock with a few exceptions.

EUR/USD has a minimum spread of 2 pips. Default margin requirements for the bigger currencies is 2%, which corresponds to a leverage 1:50. If you are an experienced trader you will have the option to choose higher leverage.

The lowest possible exposure is 1.000 base units, for example, 1.000 USD when trading the EUR/USD currency pair, so it is possible to trade currencies with relatively low exposure.

Cryptocurrencies

Markets.com and MarketsX offers Bitcoin Futures, Ripple, Ethereum, Dash, Bitcoin Cash and Litecoin. You can, for example, trade bitcoins based on CME Bitcoins futures that expire last Thursday of every month. It is not possible to leverage your position, which is why the margin requirement is 100%. You can trade bitcoin futures as a CFD contract, in which case you don’t have to own a wallet and therefore there is a lower chance of you losing your money due to a hack attack (but there are normal price fluctuations naturally). You can trade as little as 0,01 bitcoin at a time, which currently corresponds to around 67 USD. The spread is around 1,7%. If you hold your position overnight you will have to pay an overnight fee, which makes it unattractive to hold positions for a longer period of time. Bitcoin futures can be traded all day round Monday to Friday.

Markets.com and MarketsX offers Bitcoin Futures, Ripple, Ethereum, Dash, Bitcoin Cash and Litecoin. You can, for example, trade bitcoins based on CME Bitcoins futures that expire last Thursday of every month. It is not possible to leverage your position, which is why the margin requirement is 100%. You can trade bitcoin futures as a CFD contract, in which case you don’t have to own a wallet and therefore there is a lower chance of you losing your money due to a hack attack (but there are normal price fluctuations naturally). You can trade as little as 0,01 bitcoin at a time, which currently corresponds to around 67 USD. The spread is around 1,7%. If you hold your position overnight you will have to pay an overnight fee, which makes it unattractive to hold positions for a longer period of time. Bitcoin futures can be traded all day round Monday to Friday.

Education, analysis, and news

On the website, you have access to various analyses, as mentioned above. On Markets.com homepage you can participate on a daily basis in various webinars about the platform and markets behaviour.

Forced closing of positions/margin calls

Markets.com will trigger a message about margin call (message about insufficient margin), when an account balance falls to 70% (or lower) of the required margin for a given position. If the balance on the account falls under 50% of the required margin, the platform will automatically close all open positions. It is rare to see a trading platform operating with a fixed rule for forced closing of positions.

Let’s take this example:

A customer opens a 200.000 USD/JPY position with a deposit of $2.000. Margin calls for a position like this would be $1.000 (which can be perceived as used margin). Should the customer’s account fall below $700, the customer will receive a margin call message. If the account balance falls to $500, the position is automatically closed at market price.

Prices

In line with other platforms featured on this site, Markets.com’s minimum spreads are not among the best ones, but still in the right end, and they are even better when trading on MarketsX.

If you hold your positions open for a longer period of time (that is, overnight), the fees fall around 3-4%, depending on the product. Currencies are typically somewhat lower, while Bitcoins are somewhat higher. Specific fees can be seen by pushing “i” on the individual products (stated prices are per day).

CDF trades based on stocks incur no brokerage but only spread. The latter, as said earlier, is somewhat higher compared to what you find when trading directly on exchanges. On the other hand, it may be outweighed by the possibility to buy many small positions.

It also pays off to keep in mind that if you do not actively trade or deposit money for a period of 90 days, you will be charged an inactivity fee of $10 per month.

Customer service and opening an account

Markets.com’s customer service can be reached all day round on weekdays, according to their homepage. They can also be reached via e-mail or live chat (that actually works quite well). We have experienced quick response time with both emails and live chat.

Opening an account is quick and easy. You are approved to trade as soon as the platform receives required identification documents, such as a passport and account statement, which shows one’s address together with other relevant information, for example, one’s financial situation, background, and knowledge of financial instruments. If you have already opened a demo account, you can easily open an actual account using your demo one.

When it comes to the deposit of funds, Markets.com does not charge a transfer fee, and they accept credit cards, banks transfers, etc. As always, you risk being charged a fee for the transfer by your own banks or credit company. With a bank transfer (but not with a credit card or Fast Transfer) of over $2.500 (or equivalent in another currency) Markets.com offers to cover the fee you may have been charged. It’s possible to transfer funds using a VISA debit card, which typically doesn’t cost anything, and the money will be on your account right away. You can check with your bank beforehand if you’d like to make sure that they will charge you no fees.

It is vital for you to transfer funds from an account or a card with your own name. Otherwise, the transfer may be rejected.

If you wish to withdraw your funds, you can choose whether the money should be transferred back directly to your own credit card via a bank transfer or something else. The process is fastest with a credit card, while a bank transfer may take several working days. Markets.com charges no fees for the transfer, but again, you risk that your receiving bank may. Additionally, Markets.com demands the money to be transferred in the same way as they were previously moved.

Security of funds

Due to EU financial regulation, Safecap (which operates Markets.com and MarketsX) stores customer’s funds separately from Safecap’s own resources, via so-called Segregated Customer Accounts. This means that individual accounts are held separately from the broker’s own resources in case of a potential bankruptcy situation.

Additionally, thanks to Cypriot regulations (which is EU-based), in case Safecap goes bust, customers’ funds are insured for up to 20.000 EUR per customer.

As Safecap is subject to relatively strict minimum requirements for financial services providers in the EU, the company does not differ significantly from the other providers on the market. Although, some EU countries have better customer protection rules in the form of for example higher economic protection of individual customers.

Conclusion

Markets.com and MarketsX are excellent trading platforms, especially for traders that want a manageable platform and the possibility to carry out trades with low exposure. With the latest update of the graphs, the platform has become even better compared to competitors.

As Safecap is a foreign broker, you are responsible to report your profits to tax authorities and make sure to provide the required relevant documentation. The platform provides relatively good ways of acquiring data for this purpose, and if you have an account in your local currency, it’s even easier.

Spread-wise, Markets.com is not the leader. But the co-branden MarketsX is better. Also the price structure is transparent, and you don’t have to pay for brokerage or CFD trades based on stocks.

If you are a beginner, it will be comforting for you to know that you don’t risk more than your account balance, and you know precisely when your position closes if the market goes against it.

We recommend opening a free demo account to try out the platform. After that, it’s much easier to open an actual account and upload the required documentation as well as answer the questions.