What is Cardano?

Currently ranked in the top 10 of cryptocurrencies according to Coinmarketcap, Cardano is a smart contracts platform, which functions on a public blockchain. The cryptocurrency, ADA, is completely open source. What sets Cardano apart are its origins – it is the first blockchain with truly academic origins. It has been created with a research-first approach. The team also focuses on balancing users’ privacy rights with regulatory requirements. Efficiency and scalability are the guiding principles of Cardano, with upgrades implemented via soft forks and a treasury to ensure sustainability. Cardano has been built using Haskell, a programming language known for its security.

Currently ranked in the top 10 of cryptocurrencies according to Coinmarketcap, Cardano is a smart contracts platform, which functions on a public blockchain. The cryptocurrency, ADA, is completely open source. What sets Cardano apart are its origins – it is the first blockchain with truly academic origins. It has been created with a research-first approach. The team also focuses on balancing users’ privacy rights with regulatory requirements. Efficiency and scalability are the guiding principles of Cardano, with upgrades implemented via soft forks and a treasury to ensure sustainability. Cardano has been built using Haskell, a programming language known for its security.

There are three main entities behind Cardano: the Cardano Foundation is the entity that oversees and supervises Cardano’s development, which includes growing the community, driving adoption, and supporting the growth of the Cardano ecosystem; IOHK (Input Output Hong Kong), an R&D company founded by Charles Hoskinson, which carries out cryptographic research for Cardano, and is responsible for achieving the milestones set out by the roadmap. Besides Cardano, IOHK also works on Ethereum Classic. And finally, Emurgo, an organisation focused on investment and growing the Cardano ecosystem. The main goal is to drive the adoption of ADA, Cardano’s cryptocurrency, by building commercial partnerships, helping various organisations understand the decentralised ecosystem of Cardano, and investing in projects and startups that use Cardano’s technology.

The team behind Cardano has also created Ouroboros – the first provably secure proof-of-stake (PoS) algorithm, which has been peer reviewed by academics. This protocol is what helps Cardano scale and achieve high performance.

Cardano’s wallet, Daedalus, will be able to run decentralised applications (e.g. Augur, Melonport, EtherTweet), or dApps, on the blockchain.

Fun fact: Cardano has been named after a 16th century mathematician of the same name. And every stage of Cardano’s roadmap has been named after a famous historical figure, including Lord Byron, Ada Lovelace, Matsuo Bashō, and Voltaire.

Fun fact: Cardano has been named after a 16th century mathematician of the same name. And every stage of Cardano’s roadmap has been named after a famous historical figure, including Lord Byron, Ada Lovelace, Matsuo Bashō, and Voltaire.

You can read Coinisseur’s previous coverage of Cardano here.

The idea behind Cardano

The aim of the Cardano, as envisioned by its creator, lies in providing an environment for cryptocurrencies that is more balanced and sustainable. The goal is to leverage the potential of the blockchain and bring financial services to all, regardless where they are. To do this, Cardano has created a solution that is as easy to transact with as Bitcoin, includes a smart contract functionality, and supports decentralised applications (dApps).

As mentioned earlier, one of the things that sets Cardano apart is its focus on research. The process of creating Cardano, and now updating it, is heavily influenced by academics, programmers, and scientists. Any improvements undergo a rigorous peer-review system in order to ensure a high-quality development of the project.

Throughout their history, there have been several generations of cryptocurrencies. The first is Bitcoin and its forks, all implementing Proof-of-Work (e.g. Litecoin, Dogecoin, etc.). Second generation started with Ethereum, and is characterised by smart contracts and a turing-complete programming language. The third generation cryptocurrencies are those built on the previous generation that add additional features, while focusing on scalability with cross chain transaction, governance, and compliance built into the core of the blockchain. Cardano’s ADA is the first third-generation cryptocurrency, or at least the closest project (farthest developed) to belong to that category.

Roadmap – implementation of Cardano’s vision

The roadmap of Cardano is split into several stages, each focusing on a major part of the final vision: Byron (foundation), Shelley (decentralisation), Goguen (smart contracts), Basho (scalability), and Voltaire (governance).

The roadmap of Cardano is split into several stages, each focusing on a major part of the final vision: Byron (foundation), Shelley (decentralisation), Goguen (smart contracts), Basho (scalability), and Voltaire (governance).

Shelley mainnet, after delays, was finally launched in August 2020. It focused on decentralisation and community adoption. It introduced delegation and (heavily researched) incentive schemes, and a reward system to drive stake pools (instead of holding tokens as a stake yourself you can join a stake pool, which means you don’t have to use your own hardware; additionally, pools are bigger than individual holdings, increasing the chance to be picked to write a new block and get rewards). The network will eventually aim to have 1000 stake pools, which seems pretty plausible, as only days after the Shelley launch that number stood at over 700. Currently, less than 2 weeks after the launch of the mainnet, there are 915 active pools and 32.6% of the coins are staked.

Goguen focuses on smart contract integration and the ability to build dApps on the platform.

It has been in development alongside Shelley, which is why one of its goals, Plutus (a purpose-built smart contract development language and execution platform) is already available for testing. Goguen will bring smart contracts to the masses. With Marlowe (a high-level, domain-specific language for financial contracts built on Plutus), people with no technical knowledge will be able to create financial smart contracts using the Marlowe Playground. In practice, the Goguen era will significantly improve the network and the utility of the token.

The next phase, Basho, will improve the performance of the network, rather than add new functionalities. Better scaling of the network will be improved with sidechains interoperable with the main Cardano chain, which can also be used to introduce experimental features without having an impact on the security of the main blockchain.

The final phase, Voltaire, aims to make Cardano a self-sustaining system thanks to the introduction of voting and a treasury system. In the final governance model, participants will be able to use their stake to vote and influence the development of the platform. At that point, the project will no longer be managed by IOHK. Instead, the community will be the sole governors of the project.

Cardano compared

At the launch of Cardano’s incentivised testnet at the end of 2019 met with enthusiasm from the community, with 17% of the coin supply staked. Staking will be available to all users from mid-August 2020.

At the end of 2019 Binance estimated the yield to be 3.70%, pretty middle of the road. Higher than EOS, NEO, or Stellar (1.84%, 1.52%, and 1% respectively), and roughly the same as the expected ETH yield of 4%. However, it’s much smaller than those from Dash (6.33%), Tezos (6.94%), or Cosmos’ ATOM (9.65%).

The rewards from the Incentivised Testnet were actually almost twice as high, 6%-8%, depending on the staking pool. However, the IOHK estimated the rewards from the mainnet (once it launches) to be 4.6% annually, which was met with mixed feelings from the community, disappointed in a number under 5%. Tezos, similar in terms of volume and market cap, currently offers rewards of 5.48%.

According to stakingrewards.com, the current reward is 4.86%.

There is no minimum amount that needs to be staked (in most pools). You can choose a pool using platforms such as Cardano Pool Tool, or ADApools. Why join? You will not only regularly get the rewards, but you will also express your support for Cardano and the work that they’re doing.

Driving adoption through partnerships

Cardano, being in the top 10 cryptocurrencies, is undoubtedly popular. Partly due to support from the Cardano Foundation and Emurgo, which together drive the adoption of the technology by building projects, supporting and investing in those organisations that use Cardano. But arguably, what drives the continuous growth of the project are the increasing number of partnerships.

Cardano, being in the top 10 cryptocurrencies, is undoubtedly popular. Partly due to support from the Cardano Foundation and Emurgo, which together drive the adoption of the technology by building projects, supporting and investing in those organisations that use Cardano. But arguably, what drives the continuous growth of the project are the increasing number of partnerships.

When it comes to research, a few years ago, Cardano partnered up with a commercial think tank, Z/Yen Group, to research blockchain application and develop Cardano’s protocol as well as its cryptocurrency. Cardano also has a partnership with the University of Edinburgh in Scotland to support students in a number of blockchain research projects. At the beginning of 2020, Cardano has joined a Privilege consortium that focuses on the development of distributed ledger technology, which will allow Cardano to carry out and publish research on the topic. Around the same time, Cardano added IBM research and PwC to its list of collaborations.

Focusing on driving the adoption of ADA, Cardano’s cryptocurrency, the organisation has collaborated with numerous companies. Their partnerships with Metaps Plus made it possible for ADA to be used in more than 33,000 offline stores in Korea, and partnering up with COTI Network (a fintech digital payment solution company) allowed merchants to transact with ADA on their network. Additionally, their partnership with Algoz, which focuses on trading and liquidity solutions for crypto assets, increased the availability and liquidity of ADA.

As far as Cardano’s blockchain is concerned, there are a number of collaborations to note. For example, from 2018, Cardano’s protocol has been integrated into a blockchain smartphone by Sirin Labs, FINNEY (additionally, ADA has been available on its cold storage wallet and the ecosystem of Sirin Labs). In 2019, the shoe company New Balance and Cardano began a strategic collaboration, with retail customers being able to log their purchases on the Cardano blockchain. In order to drive real-world business use cases of their blockchain, Cardano partnered up with Konfidio, a venture accelerator that helps build business models for distributed systems. 2020 brought a product provenance collaboration with ScanTrust.

What sets Cardano apart are their multiple collaborations with governments. All started in 2019, Cardano has collaborated with the South Korean government to apply Cardano in digital content and mobile gaming In Ethiopia, the company has been working with the government to build a new digital payment system, and in Georgia, IOHK is working to implement Cardano’s projects in businesses, education, and government services.

There have been rumours and hints of possible collaborations with Chainlink and Litecoin, but they are yet to be confirmed. An excellent overview of all past Cardano’s partnerships is available here.

Cardano’s beginnings and history

Cardano was launched in September 2017. It has been created by a well-known name in the cryptocurrency world, Charles Hoskinson, the co-founder of Ethereum and BitShares.

Hoskinson is also the founder and CEO of IOKH, the parent company of Cardano. He was the one to drive the academic and scientific foundations of the project. He regularly hosts Q&A sessions on YouTube answering any questions from the community. He is often praised for refusing to speculate on the future price of ADA. It is also evident that education is an important part of Hoskinson’s mission and vision. He used to serve on the Bitcoin Foundation’s Education Committee as well as the Bitcoin Education Project. Now, IOHK has a number of educational courses, including two free courses on Udemy in Plutus and Marlowe programming languages.

Hoskinson is also the founder and CEO of IOKH, the parent company of Cardano. He was the one to drive the academic and scientific foundations of the project. He regularly hosts Q&A sessions on YouTube answering any questions from the community. He is often praised for refusing to speculate on the future price of ADA. It is also evident that education is an important part of Hoskinson’s mission and vision. He used to serve on the Bitcoin Foundation’s Education Committee as well as the Bitcoin Education Project. Now, IOHK has a number of educational courses, including two free courses on Udemy in Plutus and Marlowe programming languages.

During the ICO, the company raised more than $63 million. As many other cryptocurrencies, ADA experiences a surge in 2017, reaching an all-time high in the early days of January 2018 of $1.162 and market capitalisation of more than $33 billion.

The bear market of 2018 has crashed Cardano’s price along with countless others. There was a 100% spike in April and May 2018, due to the release of v1.5 Mainnet, which signalled the completion of the Byron stage of the project. The project survived the difficult year and continued to grow throughout 2019.

A major project announced in 2020 was a contract to design a cryptocurrency credit card based on the Cardano blockchain. The money was received in two parts (so far), with the launch expected by the end of 2020.

The future of Cardano

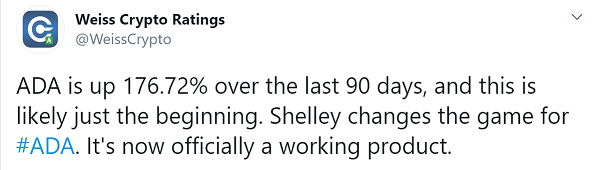

In 2020, the price of ADA has risen 150%, outperforming many major cryptocurrencies, including Bitcoin. Despite this, Weiss Crypto Ratings believes that Cardano’s run is far from over.

In 2020, the price of ADA has risen 150%, outperforming many major cryptocurrencies, including Bitcoin. Despite this, Weiss Crypto Ratings believes that Cardano’s run is far from over.

Charles Haskinson, the founder of Cardano, predicts 2021 to be the year of fantastic growth and adoption, with “hundreds of assets running on Cardano, thousands of DApps”, which has been called into question. Some industry experts believe that Cardano is set to become the second biggest DeFi platform after Ethereum.

Even if the thousands of DApps expected by Haskinson won’t become a reality in the next year, Cardano will certainly be a major player. Even giving Ethereum a run for its money. With the announcement of the $20 million development fund for projects running on the Cardano system, the company is taking steps to really become the major blockchain platform. This, of course, is quite a tall order given the competition, but certainly a possibility given Cardano’s track record of delivering the milestones set out by its roadmap.

While Charles Haskinson and the team refuse to speculate on the price of ADA, others sure did. Tradingbeasts.com predict the price to be $0.17 in January-February 2021, Longforecast believe that the price will be minimum $0.19 in January 2021, but will drop throughout the year. The most optimistic seems to be CoinSwitch, forecasting that ADA could reach $2 by 2023, and $2.88-$3 by 2025. But there are even some who believe that the project is so good that it might reach $5 or more in a matter of years.

While Charles Haskinson and the team refuse to speculate on the price of ADA, others sure did. Tradingbeasts.com predict the price to be $0.17 in January-February 2021, Longforecast believe that the price will be minimum $0.19 in January 2021, but will drop throughout the year. The most optimistic seems to be CoinSwitch, forecasting that ADA could reach $2 by 2023, and $2.88-$3 by 2025. But there are even some who believe that the project is so good that it might reach $5 or more in a matter of years.

Where and how to buy ADA

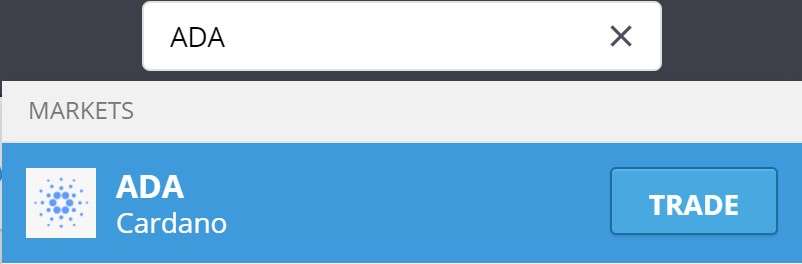

Cardano’s ADA is available on a number of exchanges, including etoro, Kraken, Coinbase, and Binance.

Where can ADA be stored?

The cryptocurrency can be stored in a variety of ways. Hardware wallets include Ledger Nano S or Trezor Model One. For other options, you might want to check out AdaLite, a Web storage wallet, where you don’t have to register or do the KYC process, or Infinito Wallet, where you can store a large number of cryptocurrencies.

Cardano and IOHK have created two wallets, Daedalus and Yoroi. Choosing between them depends on your preferences. Daedalus allows for multiple wallets and a direct connection to the network. With Yoroi, you can use hardware wallets and use it on mobile. It takes up little space, and the initial setup is instant. It also takes up less space than Daedalus (6.5 MB compared to 6.5 GB for Daedalus). However, with Daedalus you don’t need to trust a third party (it is trustless), while Yoroi relies on a trusted remote server to work. Both wallets support staking. You can look up the full comparison between them here.

How to buy ADA on etoro?

Cardano’s cryptocurrency is one of the most traded coins on etoro, along with Zcash, Binance Coin (BNB), and Tezos. Here is a step-by-step on how to buy ADA on etoro.

On etoro’s main page choose “Trade Markets” from the menu list on the left side. Search for ADA and click on “Trade”.

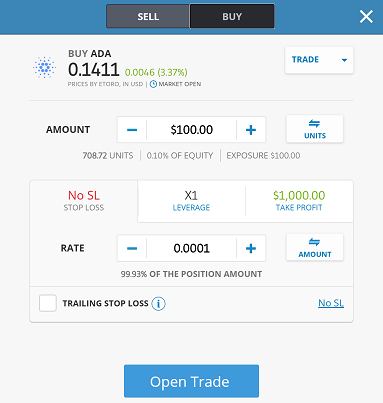

A trading window will pop up, where you can choose the amount you want to buy ADA for.

There are additional options:

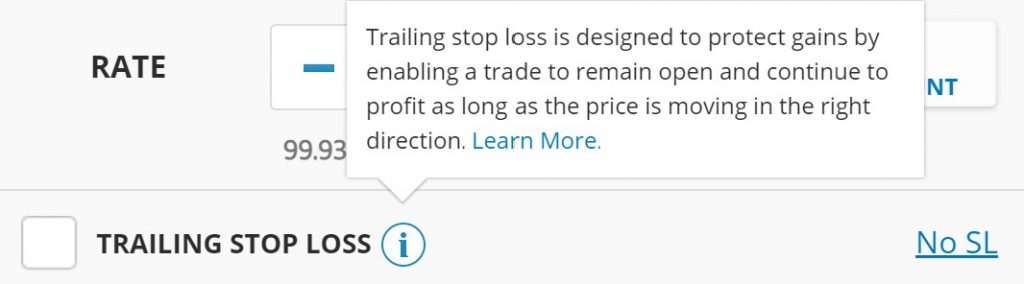

Stop loss – you can set the price below the current where you want to close the trade, should the price fall (there is a limit to how high you can set the stop loss). There is also an option for a trailing stop loss.

Stop loss – you can set the price below the current where you want to close the trade, should the price fall (there is a limit to how high you can set the stop loss). There is also an option for a trailing stop loss.- Leverage (only x2)

- Take profit – set a price where you want the trade to close to take profit.