![]() Tradeshift is a platform for supply chain payments, e-invoicing, and marketplaces for enterprises. It is a cloud-based business network facilitating digitization of trade financing and data sharing between buying and supplying companies via apps.

Tradeshift is a platform for supply chain payments, e-invoicing, and marketplaces for enterprises. It is a cloud-based business network facilitating digitization of trade financing and data sharing between buying and supplying companies via apps.

With headquarters in San Francisco, Tradeshift currently services hundreds of global enterprises by connecting to 1.5 million business entities across 190 countries and processing half a trillion USD. Tradeshift has won several awards, such as Best Business Start-up (2010) by TechCrunch Europe, or EY Entrepreneur Of The Year US Award (2017) just to name a few. It has also been featured in the top 100 cloud-based Enterprise Software Startups (2015) and 50 Highest Rated Private Cloud Companies to work for by Fortune (2016). In 2018 it has earned a unicorn status (a company valued at over $1 billion).

I was lucky to interview Mads Stolberg-Larsen, who joined Tradeshift Frontiers, Tradeshift’s digital innovation department, in October last year as a Blockchain specialist to explore how Tradeshift can leverage Blockchain technology.

| At eToro you can trade 49 currency pairs, including several cryptocurrencies. Join eToro |

Coinisseur: What is the goal of Tradeshift and how do you leverage Blockchain technology?

Mads: The vision for Tradeshift is to connect every company in the world and thereby create economic opportunity for all. Blockchain is a technology that maybe, maybe not, can facilitate that.

We believe Blockchain is a game-changer when it comes to the transfer of value. It is around value that the technology has inspired new use cases, and arguably it is where smart contracts truly come into play.

We are working on integrating the information flow, purchase orders, invoices, etc., by embedding the payments flow into business contracts We believe that that is going to create a lot of value in B2B commerce so we are testing how to do it.

C: What are the issues that Tradeshift aims to solve?

M: The hurdle now, today, in creating Fintech apps is that you need to access the value somehow. And the only way you can do that is through banking APIs. And that is what PSD 2 essentially solves.

M: You can start transferring money through these APIs, you can start accessing your value, and third parties can actually start to expose the value that I have on my bank account across different banking actors. As long as I, as a user, give my consent to an app developer, he can source what I have on my bank account from a number of different banks. That’s what open banking provides. And the problem is that these APIs are not so mature yet. The really cool thing you can see Blockchain and DLT providing is basically the open-source infrastructure for the same value interaction. Solutions like Blockchain/DLT can serve as a common layer for interacting with value. It’s a little abstract, but it does mean that as a developer you know that a single player can’t pull the rug from under you.

This comes to the old vs new way of thinking. Although it’s really not that new. The old way is for a central committee to spend time together and then set a standard on how we do things. And once we have that standard, we’re going to implement it all over the world. So it’s actually not old vs new but more bottom-up vs top-down. If we take ISO standards as an example: the process is democratic, with a lot of different actors engaging and setting it, but it is a top-down one. The ISO certification body spends a significant amount of time on deciding what “interoperable blockchains” ought to look like and then degrees that. What we see in

the Blockchain space, for example with Ethereum and developments therein, setting ERC-20 and other standards, where it’s more bottom-up – people just use it, essentially, and the fact that they are using it means that it becomes a standard.

It’s going to be interesting to see how new standards are going to be set, is it going to be conversations around what the standards should be, or is it going to be bottom-up where some developers just decide: “This is how we’re going to do things”. And then they do it, and then by doing it, it becomes the standard. The vote’s still out.

C: Just to underline it. What makes Blockchain so relevant to Tradeshift?

M: Again, Blockchain is just one component of the technology stack. It’s a fairly important component if you decide to use it because it’s essentially your accounting ledger for who owns the value. It’s really important to say that the component you are looking for is an accounting ledger for who owns the value. Whether you use Blockchain, a centralised database, or something in between (permission DLT, for example), well, that’s a design choice with its own ups and downs. What’s interesting is that we have now a new technology that has inspired a lot of thinking around what is it and what can we use it for.

C: I’ve heard you say that Blockchain is open banking on steroids. Can you elaborate?

M: Yes. What is open banking? It’s making APIs available so that programmers can create Fintech apps and thereby interact with value.

What is a (public) Blockchain? It is an open fintech infrastructure that anyone can innovate on top of. And a lot of Blockchain developers, companies, and other organisations have spent a lot of time making it easier to create apps on top of the protocol so that you can interact with value. It’s going to be interesting to see: are the banks going to make their APIs open and available faster than the Blockchain space is going to be able to overcome regulatory hurdles and put value into decentralised infrastructure? The race is on!

Coinisseur: Is it like setting a fire under banks’ feet, either innovate or die?

M: No. [Laughter] I think that’s too much black and white.

Blockchain provides an alternative, but it requires that you overcome the regulatory and scalability burdens. But if you do that, then you have an alternative with an open infrastructure that is very transparent in how it works and how it is influenced. That might not be the case in the banking situation. Not as much, anyway. It will be centralised parties that control that. When banks create a consortium, it leads to more transparency. R3 is a very nice defensive move in terms of making the infrastructure available across a large set of players. This is what banks see in it. So the point is, it’s not that black and white.

C: You’re part of Tradeshift Frontiers. What is it?

M: Tradeshift Frontiers is the digital innovation arm of Tradeshift that explores how to leverage emerging technologies.

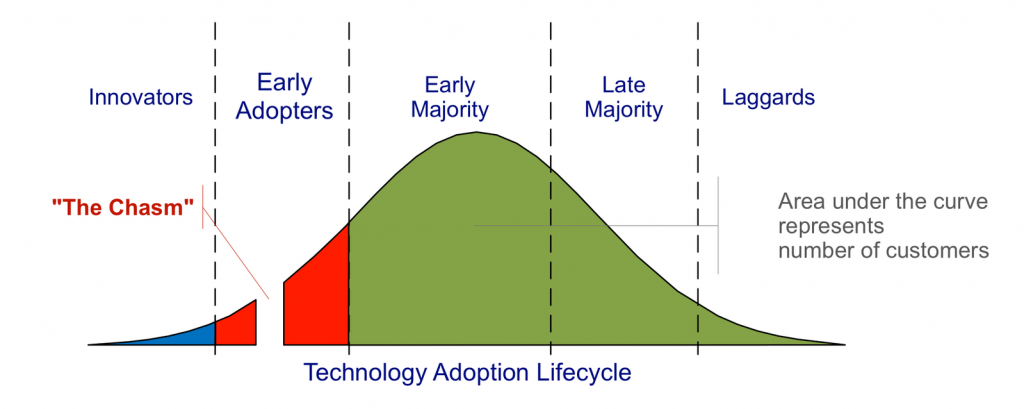

We’re looking at how we can create new products for supply chains on a 5-year horizon. That is the horizon we have our eyes on. Having a long-term view and making sure that you’re on the right S-curve. It’s a well-known fact that many technologies go on an S-curve, and once you’ve crossed the chasm, adoption can happen really quickly.

If you’re not on that adoption curve when things take off, you simply miss it or you have to create some defensive moves. That is also what we’re doing at Frontiers – we’re looking into the important S-curves that Tradeshift needs to be on as a company. And where is it that we, together with our partners, can create value together.

C: Speaking of partners, can you share some of your partnerships?

We have several partners and even more evolving relationships. We are working with Maker, because we see and believe in their decentralised vision of implementing a stablecoin. We also see a lot of opportunities in what they are doing with collateralized debt positions (CDPs). Our partnership with Maker is one of many, but it has gotten a lot of attention from the Blockchain/crypto space. Another interesting partnership we have is with Deloitte. This work has been focused more on figuring out consumers’ needs in relation to supply chain transparency. We also have a healthy number of relationships with some major banks.

C: What are the “smart invoices”?

We are working on “smart invoices” – invoices based on smart contracts [contracts written in code that self-execute based on predetermined conditions]. As it is impossible to create a solution on Ethereum that automatically triggers the transaction at the due date, we have instead focused on creating a flow that ensures that once the due date is reached, anybody can trigger the execution of the contract.

In order to settle an invoice, three contracts are used. Smart Invoice, a simple contract containing the vital information (payment amount, due date, payer, and beneficiary for the payment) that a buyer commits to (after auditing). Committing to an invoice means that anybody can activate the payment when the due date is reached. After finalising the smart invoice, we tokenise the payment by creating a Smart Invoice Token. Holders of the contract are entitled to a share of payments once the invoice is settled. This allows businesses to sell invoice tokens before the due date in order to get early payment. And finally, the wallet. Both parties control their smart contract wallets, which interact with smart invoices and store value. We have chosen a stablecoin DAI from our partner MakerDAO to settle payments.

You can read about the smart invoice test here. Be aware that it is not meant to handle large volumes of invoices right now. Instead, we wanted to show the potential of smart contracts and Blockchain within the B2B space.

| eToro is the world’s leading brokerage platform for social and copy trading. A 1000 different products are available on eToro, divided into 12 stock indices, 7 commodities, 53 ETFs, 49 currency pairs, including several cryptocurrencies (e.g. Bitcoin and Ethereum). Leverage of up to a 100 (leverage degree differs for some assets) is available. In our opinion, eToro is the best regulated exchange. You can join eToro here |