Central Bank Digital Currency (CBDC) relates to a new form of money – digital money created by the central bank, rather than commercial banks as it is now. Central banks around the world are discussing it, some of launching pilot projects.

Central Bank Digital Currency (CBDC) relates to a new form of money – digital money created by the central bank, rather than commercial banks as it is now. Central banks around the world are discussing it, some of launching pilot projects.

What is CBDC? What are its upsides and risks? How can it be implemented? Can we see CBDC on the horizon already?

These are just some of the questions I asked Tommaso Mancini-Griffoli, the Deputy Division Chief in Monetary and Capital Markets Department at the International Monetary Fund (IMF). With experience from Goldman Sachs, Boston Consulting Group (BCG), Silicon Valley, and the Swiss National bank, Tommaso currently advises country authorities on monetary policies, and evolving monetary policy frameworks.

Coinisseur: How would you explain what Central Bank Digital Currency (CBDC) is?

Tommaso: There are essentially two parts to the liabilities of a central bank: reserves and cash. The reserves are the digital form of money that only major banks can hold, used by banks to settle payments between themselves. The second is cash, a central bank liability (central bank money). We can use cash for our own means of payment and store of value. Currently, we mostly use commercial bank deposits to make payments and to store value – most of the payments we make during the day are made using a little plastic card, perhaps even a phone-based application. That’s how we usually pay. To us, this is a deposit in a commercial bank, but more generally, it’s called commercial bank money. Commercial banks are free to create this money when they make a loan. They can actually expand their balance sheet, and by doing so create more commercial bank money. If they do this under regulation and supervision, they respond to the cost of (holding) money, which is the interest rate that the central bank sets. Central banks are involved in the process of monetary creation by the commercial banks, but it’s outsourced. They supervise it, they regulate it, they set the costs of money, but they’re not actually generating it.

That’s the landscape that we currently live in. The idea of a central bank digital currency (CBDC) is to create a digital form of money, which is central bank money (a liability of the central bank), and which individuals can hold. Before, only banks could hold a liability in a central bank. Now, with CBDC, we (households, individuals, firms) could also do that. That’s essentially what it is.

C: What would be the upside of having it?

The central bank is an institution of the state that has public policy goals, and that is accountable to the public. Let’s consider those two separately.

First of all, the central bank should be concerned with creating a form of money that satisfies certain criteria that the public has, as an institution accountable to the public. These criteria are access, speed of settlement, safety, security, etc. If a central bank believes that the private sector is not delivering on those criteria, it may want to step in and offer a form of money that we can directly hold. That’s in terms of being accountable to the public.

The central bank is also concerned with public policy goals. There are several reasons that could justify having central bank digital currency. One is financial inclusion and the costs of maintaining a payment system. The reason I put those two together is that those are typically the goals that central banks in emerging markets and in lower-income countries have when they think about central bank digital currency. Financial inclusion – the idea is that in some remote areas (for example islands or hard-to-get-to places) it’s hard to get cash. It’s hard for people to transact and access the financial system. It’s also expensive for the state to provide cash in those areas (it’s risky, etc.). Central bank digital currency may help satisfy the two goals of financial inclusion and costs of maintaining a payments system.

There are other reasons, and that is consumer protection and stability of the payment system. Those are concerns that are generally shared by advanced economies. If cash usage disappears, and in some countries, cash is hardly used – Denmark and Sweden are good examples, with many countries moving in that direction as well. The concern that central banks have is that the payment system will be increasingly dominated by a few private players. And if that’s the case, these players may profit from excessive monopoly power, which may put the payment system at risk if they decide to exit the country.

Let’s assume that there is a foreign firm that runs your payment system. If they decide to exit due to whatever reason, or they go bankrupt, you’re in trouble.

Let’s assume that there is a foreign firm that runs your payment system. If they decide to exit due to whatever reason, or they go bankrupt, you’re in trouble.

Then there’s the additional goal of facilitating the trade of assets that are on the Blockchain. That’s something very new, and I think that we haven’t thought enough about this. If we’re going to put assets on the Blockchain, because we believe it’s cheaper and more efficient, we’re gonna have to find a way to pay for these assets.

If I want to buy stocks that are on the Blockchain and I have to pay for them by wire transfer or cash, it may be costly. But if I have cash that’s on the Blockchain, that’s tokenized, I could use that for the transaction – it would make the whole thing much easier.

Of course, there are all sorts of possibilities that extend from that: the possibility of programming money, embedding payments in smart contracts, etc. But that’s only possible if there is an infrastructure for payments in digital tokens.

C: What about risks?

CBDC is complex, and each decision has an effect. Let’s consider an issue we’ve talked about: few credit provider players on the market. Currently, central banks see it as a risk to which they might respond with a central bank digital currency. On the other hand, should that happen, if a new, safe, liquid, way of holding wealth is offered, people might want to choose that instead. This might lead to disintermediation of the banking sector (the risk of disintermediation is conditional on the issuance of CBDC). We should be concerned with this, and we need to think through what the implications are on credit provision and on the stability of banks. If there are a small number of large credit providers that go bankrupt or drop out of the market, it would also give rise to risks in those areas that CBDC can help the most: consumer protection, the stability of the payment sectors, and safety of the payment system.

Monetary policy transmission would not be put at risk by introducing a central bank digital currency. I think monetary policy will continue to be effective, and that is because the central bank will always be able to determine the interest rate on very short-term securities.

An extreme theoretical case could be where the banking sector is completely disintermediated. The central bank could still offer interest on CBDC. We would then make our economic decisions based on the interest rate on CBDC, as opposed to the interest rate that banks charge us on loans.

An extreme theoretical case could be where the banking sector is completely disintermediated. The central bank could still offer interest on CBDC. We would then make our economic decisions based on the interest rate on CBDC, as opposed to the interest rate that banks charge us on loans.

So to the extent that a central bank can still manage the interest rate, monetary policy should continue to be effective. A central bank may have to change its operation somehow, but it should still remain effective.

C: Can regulation help solve the current monetary issues?

Regulation could be used to solve problems – just put certain regulations into place to limit monopoly power, to limit the price of making payments, ensure that you have backup systems, etc. But those regulations may be insufficient – the regulatory regime may be weak, or because they’re trying to regulate natural monopolies (there are very strong network effects in payments – if there’s a firm that offers you and me payments, both of us will use it because then we can pay each other). There are all sorts of reasons to believe that there are limitations to regulation.

Central banks are thinking of other solutions, such as incentivizing the private sector to provide appropriate solutions. But short of succeeding with those means, they may consider introducing a central bank digital currency as an actual direct competitor to the private sector in the area of payments, or at least as a backup solution in case a solution offered by a private firms breaks down.

I’m not saying the regulations are not going to be ineffective, some regulations will be very effective, and that may be the right way to do it. But in some countries, the power of regulators is simply not so strong, and so CBDC may be a useful solution.

C: How could CBDC be implemented?

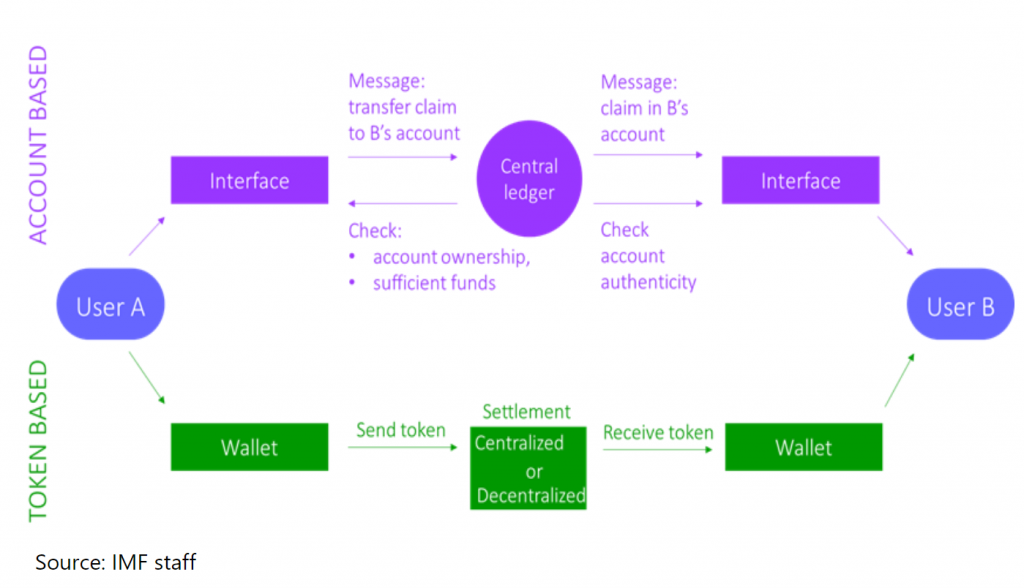

First of all, CBDC does not necessarily have to be designed as a blockchain enabled token. In fact, a lot of the central banks considering CBDC are thinking about accounts or some sort of accounting system. Not necessarily issuing a token on the Blockchain, as it still has a lot of problems (scalability, environmental costs, the finality of payments, etc.), and until those technical issues are solved, it will be difficult for central banks to issue central bank digital currency to the extent that they want to. It’ll be difficult for them to issue it as a blockchain-enabled token. They are probably going to do it as either a centralized type of token, where there’s only one node – the central bank that issues and destroys tokens, or as an account at the central bank, where you and I would have an account with the central bank.

There are other ways to think about designing a CBDC. One of the ways has been discussed by Mr Tobias Adrian, the director of the monitoring capital markets department at the IMF. His remarks in Stablecoins, Central Bank Digital Currencies, and Cross-Border Payments: A New Look at the International Monetary System (available here) are visionary, suggesting that CBDC can be offered through a private/public partnership – the private sector issues the coin, designs it, picks the technology, interfaces with the public, deals with customer relations, and takes the risks of credibility etc. relative to this offering. Moreover, because this is a stablecoin that’s 100% backed by fiat currency, the money that the customer deposits with the stablecoin issuer is then placed in a reserve account at a central bank. And the issuer could be any start-up, any social media company, anyone that decides to offer a payment solution. This model of CBDC, where several steps have been outsourced to the private sector, has been named a synthetic central bank digital currency.

Suppose you’re using my chat application, where you can send emojis to your friends. In the future, I would like to enable you to send money to your friends with the same application, same interface, with a click of a button. So what I’m going to do is issue what is called a stablecoin (what is a stablecoin?) to you. So you’re gonna give me a dollar and I’m gonna give you one dollar worth of tokens. That token is always gonna be worth a dollar, because I have dollars in my account, and you can always redeem the token for a dollar. To make sure that you believe me I’m going to take this dollar you just gave me and put it at the central bank in reserves. If that’s the case, the dollar is super safe and super liquid – you can redeem it at any time. You now also have full faith that the token you have for transaction purposes is fully backed by central bank money. And if that’s the case, I have actually created a central bank digital currency, a synthetic version (synthetic central bank digital currency).

Suppose you’re using my chat application, where you can send emojis to your friends. In the future, I would like to enable you to send money to your friends with the same application, same interface, with a click of a button. So what I’m going to do is issue what is called a stablecoin (what is a stablecoin?) to you. So you’re gonna give me a dollar and I’m gonna give you one dollar worth of tokens. That token is always gonna be worth a dollar, because I have dollars in my account, and you can always redeem the token for a dollar. To make sure that you believe me I’m going to take this dollar you just gave me and put it at the central bank in reserves. If that’s the case, the dollar is super safe and super liquid – you can redeem it at any time. You now also have full faith that the token you have for transaction purposes is fully backed by central bank money. And if that’s the case, I have actually created a central bank digital currency, a synthetic version (synthetic central bank digital currency).

C: So anybody who would issue a stablecoin backed by money that’s in the central bank would, in fact, issue central bank digital currency?

Yes, that is correct, but there are all sorts of caveats to that.

- it has to be very clear and enforced by regulation and supervision that a solution has one for one backing, or in other words, that it has not issued more tokens than there is money in the reserve account.

- it has to ensure that all the money received from you is put at the central bank.

- the money that is at the central bank has to be somehow isolated from other creditors so that if a given solution or project goes bankrupt for whatever reason, you as a user will be able to get your money back from the central bank.

There are ways to design this, but it takes a legal framework to do it so that you actually have, in a way, a claim on the central bank. But if you’re able to ensure that via regulation or supervision, then you as a user are essentially holding and transacting in a central bank liability. And if that’s the case, bingo! we have a central bank digital currency.

That’s a totally new way to think about central bank digital currency. It has a lot of advantages, and it doesn’t have a lot of the costs while interfacing with the customer (central banks have to deal with know your customer and anti-money laundering regulation, as well as other compliance costs). Picking a technology and fixing bugs is all done by the private sector. It’s an outsourcing model under the supervision of a central bank. This is only a possibility currently, we’re only starting to speak about this. The IMF has been the first to discuss this, and we’ll continue to investigate it and discuss the topic with central banks. There are pros and cons, and it certainly seems worth considering.

C: What has been done regarding CBDC around the world?

There are several central banks, not a lot, but there are several central banks that are considering the possibility of introducing a central bank digital currency and preparing themselves to run a small scale pilot to test out the technology, to see what issues they may encounter, and also to test the interest of the private sector – see how banks respond (whether they sign up for this or not). In 2017, Uruguay has announced a central bank digital currency pilot, which just finished. It was very successful. Sweden is considering the introduction of a pilot, Eastern Caribbean Central Bank has just started a pilot program as well. China has been considering a pilot.

Central banks in very large and very small countries, advanced and emerging economies, each has its own reasons to think about launching a central bank digital currency.

| eToro is the world’s leading brokerage platform for social and copy trading. A 1000 different products are available on eToro, divided into 12 stock indices, 7 commodities, 53 ETFs, 49 currency pairs, including several cryptocurrencies (e.g. Bitcoin and Ethereum). Leverage of up to a 100 (leverage degree differs for some assets) is available. In our opinion, eToro is the best regulated exchange. You can join eToro here |